Commentary

The purpose of this section is to build a narrative around our approach to sustainable investing. Included in this section are monthly commentaries from Q3 2022 and our outlook for Q4 2022.

July 2022

The World Weather Attribution (WWA) initiative, a collaboration between climate scientists at multiple organisations including Imperial College London, has been plenty busy investigating the relationship between intense heat and climate change. Heatwaves like those in Russia in 2020, the USA in 2021 and India earlier in 2022 would have been almost impossible without a boost from human-caused climate change. Record temperatures in the UK in mid-July were both higher and made more likely due to climate change. It is thus alarming that during the same week, the UK’s strategy to combat the climate crisis was determined to be unlawful.

Consequently, the government will have to update the strategy to ensure that realistic expectations can be set and met. The climate change hot potato continues to be tossed about; both central bankers and whistleblowers from the private sector (like Tariq Fancy, ex-CIO for sustainable investing at BlackRock) have recently called on governments to take a leading role in the transition to a more sustainability-minded planet. The result of the legal challenge in the UK is a useful reminder that climate change, a whole-of-economy problem, requires a whole-of-economy solution (the potato should be shared between the public sector and the private sector).

August 2022

The USA was an ESG-shaped bad news magnet for most of the summer. In June, the Supreme Court eliminated the constitutional right to an abortion, dealing a material blow to human rights and overruling almost half a century of legal precedent. Later that month, the same group of Justices restricted the ability of the Environmental Protection Agency (EPA) to regulate greenhouse gas emissions.

More recently, Republican lawmakers have attempted to restrict the growth of the ESG ecosystem by demanding that pension funds turn a blind eye to ESG data and, in Texas, by blacklisting institutions deemed to be unfriendly towards the fossil fuel industry. So it was with great surprise that Senate Majority Leader Chuck Schumer and Senator Joe Manchin introduced the Inflation Reduction Act in late July.

The bill, a sequel to the quashed Build Back Better Act, passed the Senate on 07/08, passed the House on 12/08 and was signed into law by Biden on 16/08. It is generally agreed to represent the most ambitious climate action ever taken by Congress; USD369 billion of spending on a cocktail of emissions-cutting measures that, all told, closes about 2/3 of the gap between current policy in the USA and its 2030 climate goal.

The focus on carrots (subsidies and tax breaks) rather than sticks (penalties and taxes) improves the prospects for domestic clean energy companies and was a primary driver behind our decision to tactically add exposure to this sector across the ACUMEN portfolios in August (we maintain exposure to the sector on a more strategic basis across our ESG-labelled models).

September 2022

Trade-offs, which before were mostly downplayed or ignored, are now surfacing left, right and centre across the ESG ecosystem. BlackRock, the world’s largest asset manager, aptly captures this meeting of rubber with road. For years Larry Fink, BlackRock’s boss, has encouraged companies to disclose more and better ESG data and to explain how they plan to transition to more sustainability-minded business models. He is now being criticized for both overstepping his mandate (by critics of ESG) and for taking too few steps (by advocates for ESG) for someone managing more than USD8 trillion of client assets.

The Glasgow Financial Alliance for Net Zero (GFANZ), a coalition of financial institutions (including BlackRock) committed to accelerating the decarbonisation of the world economy, has begun to crumble under the realities of the commitment. As investors (allocators of capital) increasingly struggle to match their ESG words with ESG action, they might become less willing and able to ask that companies (recipients of capital) step up their own efforts. This would be an unfortunate outcome because Vicente Bermejo and colleagues recently found that investors yield significant influence over the environmental and social policies of companies; more, in fact, than the CEOs of companies themselves.

Q4 2022

In September Yvon Chouinard, the founder of outdoor apparel maker Patagonia, gave away his company. Specifically, the voting stock of the company was transferred to the Patagonia Purpose Trust (Trust)and the common stock of the company was transferred to the Holdfast Collective (Collective).

The Trust has been tasked with preserving the company’s values and the Collective, a charitable organisation, will use the company’s excess profits to combat climate change. Patagonia is a rare example of a for-profit organisation successfully balancing the obligation to preserve the financial health of the company whilst always considering the impact of the company on stakeholders (including the environment).

Patagonia, we think, reflects what most people imagine (or hope) the ESG ecosystem to look like. There is some reality in this reflection but it is certainly not the whole story, which is best illustrated by reviewing our sustainable investment framework. Of the pillars that constitute our framework, a company like Patagonia slots nicely under impact (not ESG or ethics) due to its dual mandate: to preserve financial health and to combat climate change.

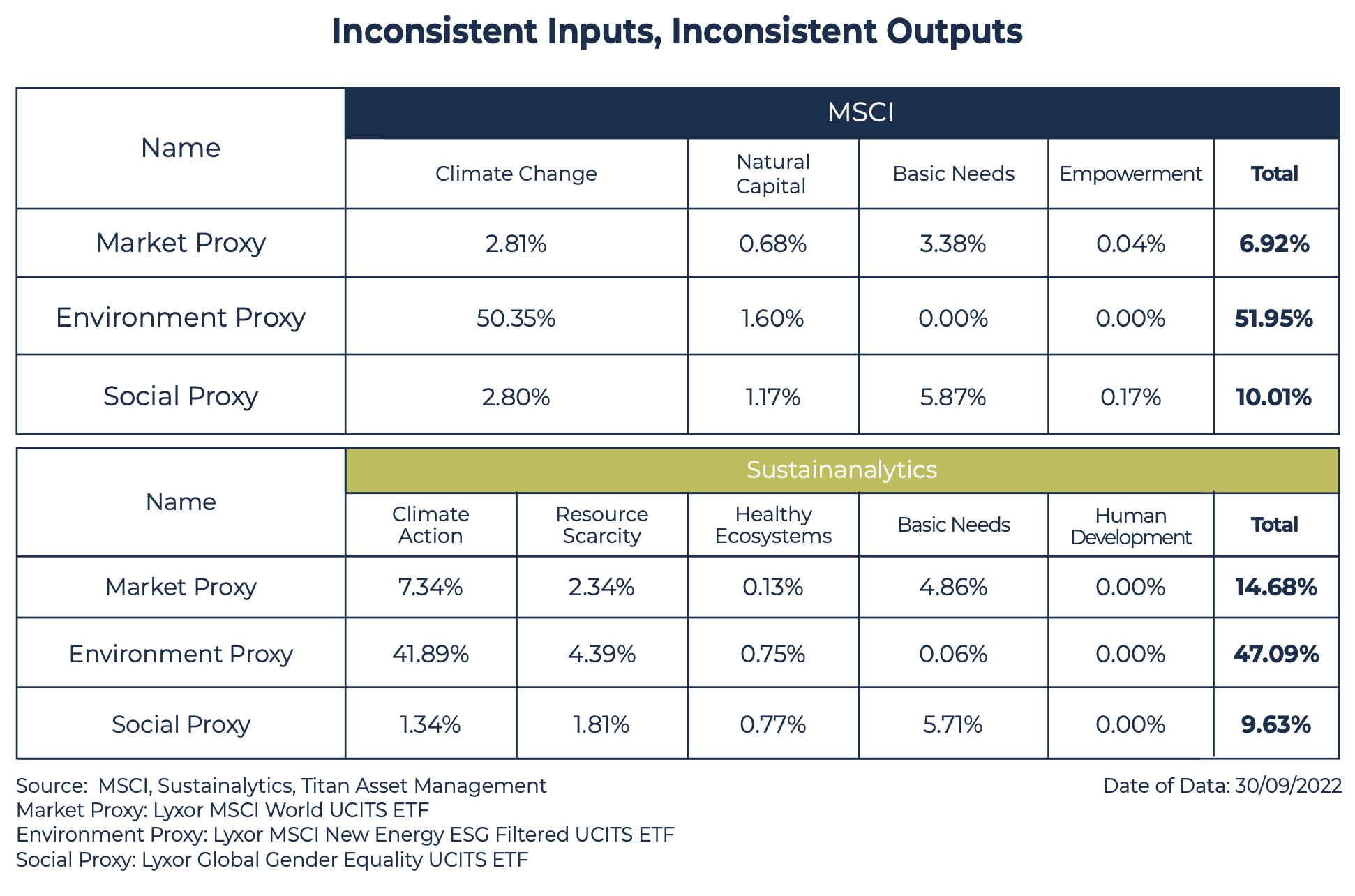

For investors (rather than companies) the calculus is a little more complicated. Impact has become a more popular strategy in recent years but its growth has been restricted by the fact that when managing a portfolio of assets or liabilities, outcomes are trickier to measure than goals are to set. This is illustrated by the accompanying table. At first glance the impact achieved by the proxies does not differ meaningfully between the MSCI dataset and the Sustainalytics dataset. But as is usually the case in the ESG ecosystem, the devils lie in the detail.

First, it is unhelpful that the impact categories are not the same. Second, the Sustainalytics dataset suggests that the positive impact achieved by the market proxy is more than double MSCI’s best guess. Third, the social proxy generates more impact than the market proxy according to MSCI but not Sustainalytics. In all, the comparison reinforces the importance of looking under the methodology hood of each data provider and that it is likely a good idea to use more than one dataset for impact analyses.

Patagonia is explicitly impact-oriented. But there aren’t many successful companies like Patagonia (in public or private markets) and the data necessary to gauge whether investors are achieving any positive impact in their capital allocation is inconsistent. So, while impact is a primary pillar within our sustainable investment framework (and we have exposure to several innovative funds with a dual mandate), it is important to emphasise that it is not fully representative of the ESG ecosystem.

Case Studies

The purpose of this section is to explain the sustainability argument behind our investment decisions.

Equity / Fixed Income: Engine Room

We designed a simple investment policy to separate ESG leaders from laggards, and to exclude certain controversial sectors from our investable universe. This policy is now almost 3 years old. Since the launch of our ESG-labelled models, we have observed material growth in the size and quality of our investable universe, mostly due to product innovation. Consequently, an oft-used criticism of the ESG ecosystem that, from a portfolio construction POV, there is a lack of product diversity, has become outdated. In fact, the engine room of our models is now a bastion of unremarkability.

The core of our equity book is split equally between the following funds: Baillie Gifford Responsible Global Equity Income Fund, Liontrust Sustainable Future Global Growth Fund, Schroders Global Sustainable Value Equity Fund. The Baillie Gifford fund provides global, large-cap blend exposure (P/E of 18.4x). It achieves an MSCI ESG Quality Score of 8.66 (AAA) and top holdings include Albemarle, Novo Nordisk and Sonic Healthcare. The Liontrust fund provides global, large-cap growth exposure (P/E of 25.4x). It achieves an MSCI ESG Quality Score of 9.12 (AAA) and top holdings include Cadence, Intuitive and Thermo Fisher Scientific. The Schroders fund provides global, large-cap value exposure (P/E of 9.7x). It achieves an MSCI ESG Quality Score of 10 (AAA) and top holdings include BT, Carrefour and Pearson.

The core of our fixed income book is split equally between the following funds: Dimensional Global Sustainability Fixed Income Fund, Pictet Global Sustainable Credit Fund. The Dimensional fund provides global, multi-sub-asset class exposure and has a duration of 6.73 years. It achieves an MSCI ESG Quality Score of 8.75 (AAA) and top corporate holdings include BlackRock, Nordea and Sumitomo Mitsui. The Pictet fund provides global, corporate bond exposure and has a duration of 5.11 years. It achieves an MSCI ESG Quality Score of 9.43 (AAA) and top corporate holdings include Iberdrola, Kookmin Bank and Telecom Italia.

Altogether, the engine room is finely balanced from a financial POV and, due to our investment policy, robust from a non-financial POV.

High Level Statistics

The purpose of this section is to measure how well we are managing exposure to material ESG risks and opportunities. Looking at the charts in this section, we can see that we are managing exposure to material ESG risks and opportunities well, scoring better than the market comparison in each instance.

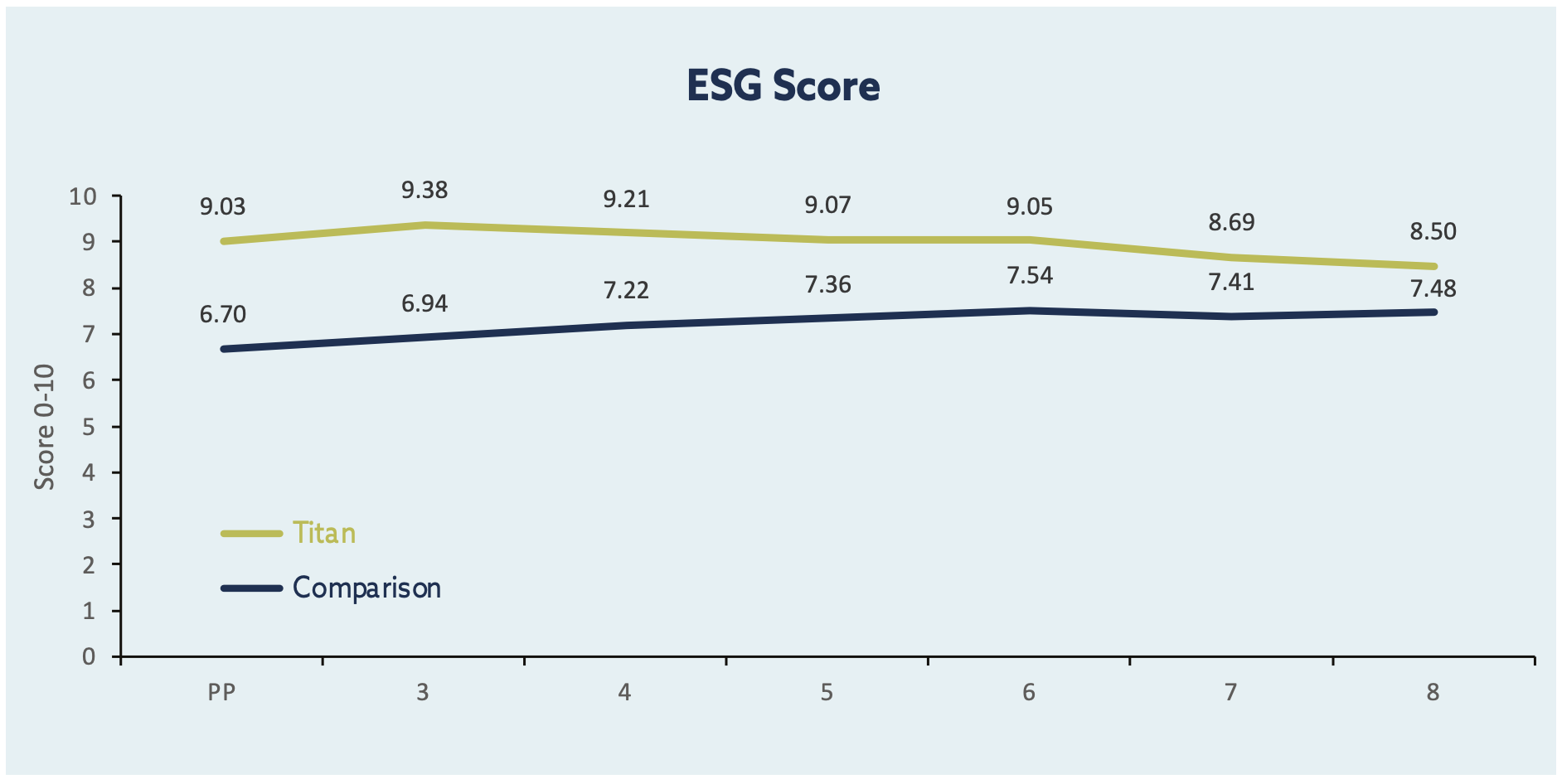

ESG Score

The score is a simple measure of how well key medium- to long-term ESG risks and opportunities are being managed and is measured on a scale of 0 to 10 (worst to best). In each instance, we (green line) achieve a higher score than the market comparison (blue line).

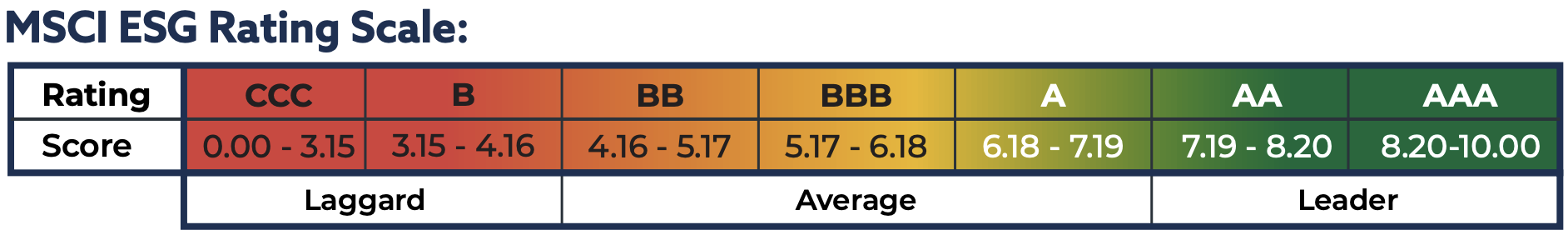

ESG Rating

The rating corresponds to the score (above) and is measured on a scale of CCC to AAA (worst to best). The entire proposition achieves a best-in-class AAA rating.

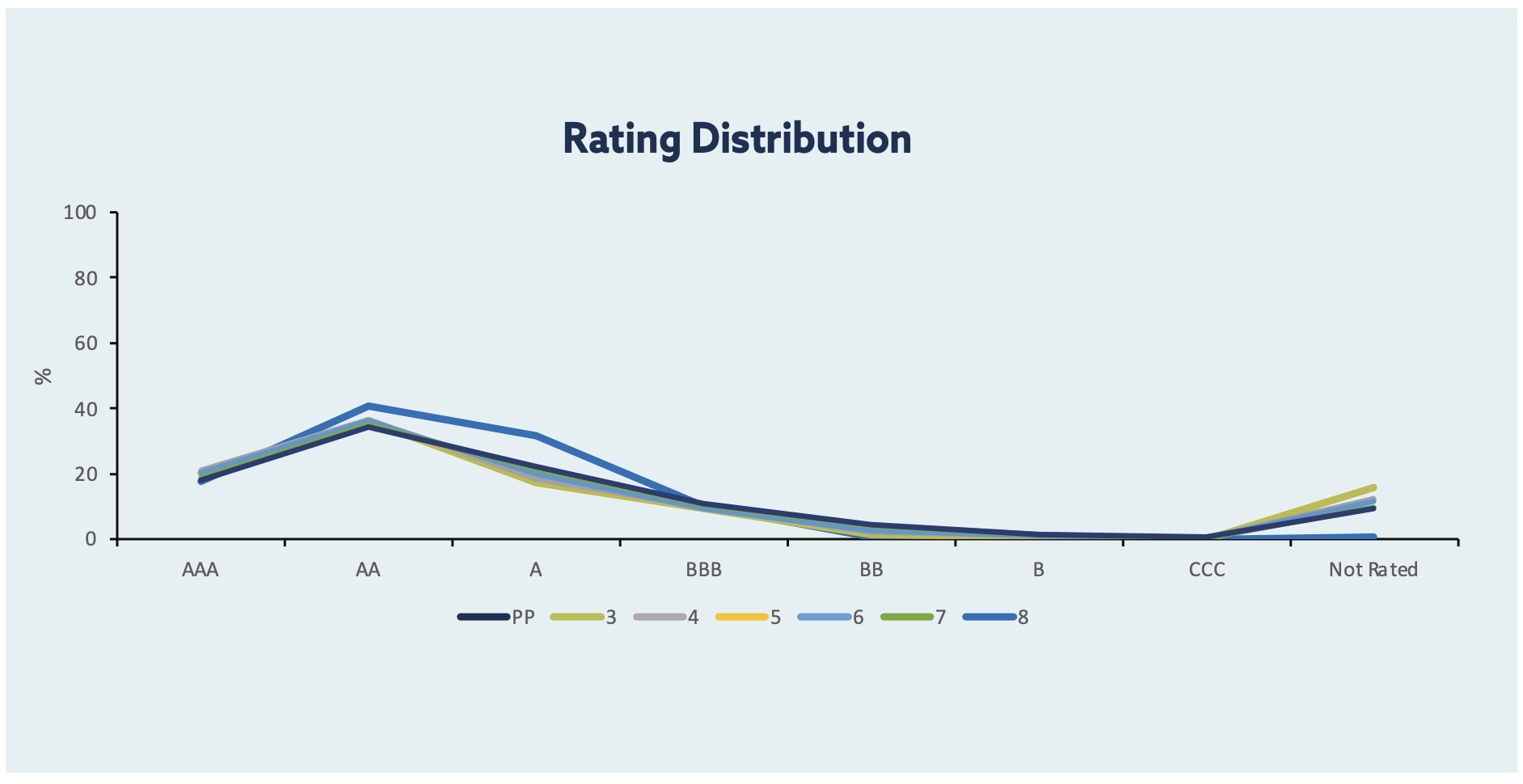

ESG Rating: Distribution

The majority of the underlying holdings across the proposition achieve an A rating or better.

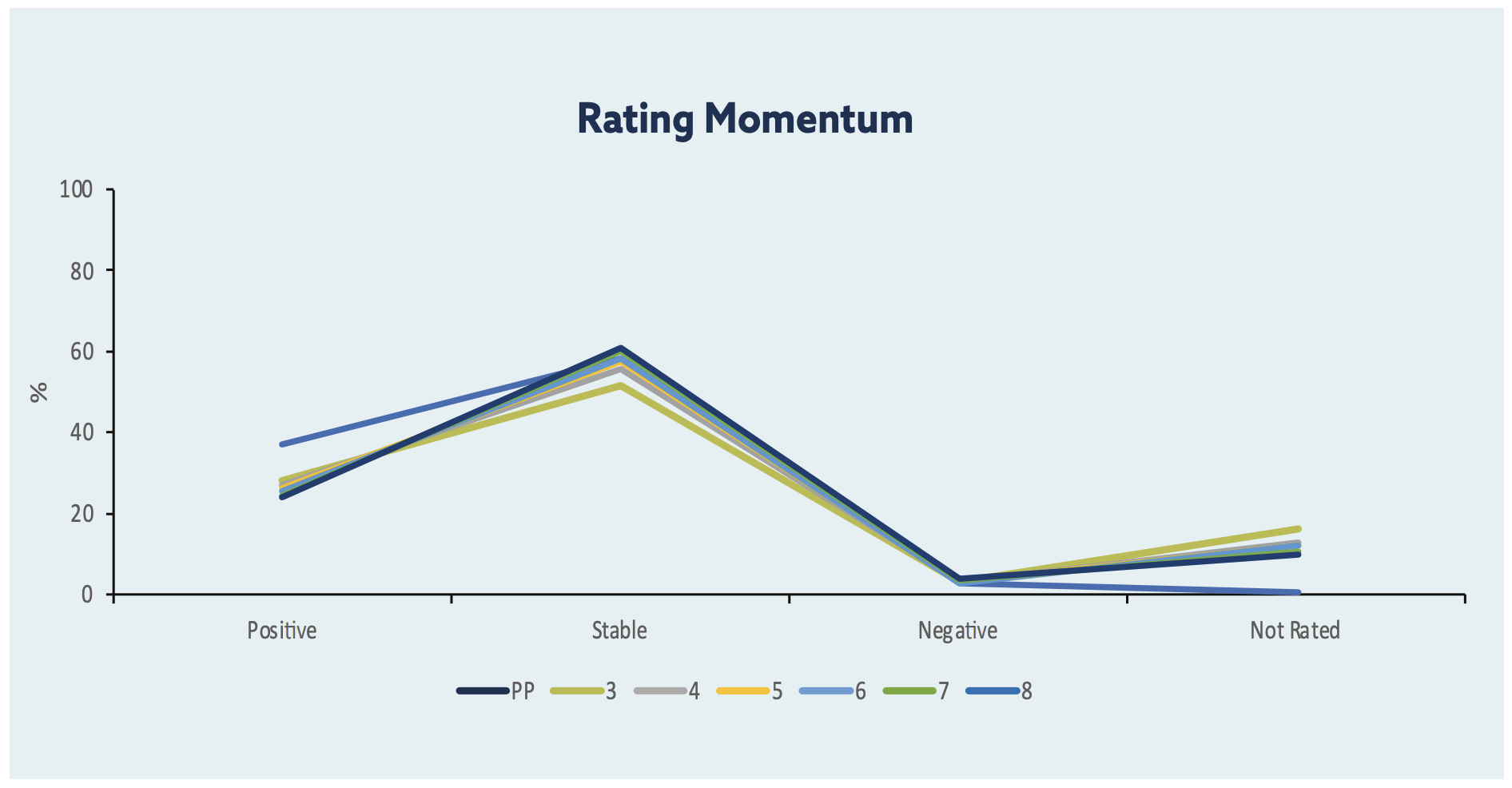

ESG Rating: Momentum Distribution

Momentum is split into the following categories: negative, stable, positive (worst to best). The rating will have positive momentum if it has increased since the last rating assessment by MSCI, vice versa for negative momentum. A rating with positive momentum indicates that this underlying holding is improving its management of key medium- to long-term ESG risks and opportunities. Almost all of the underlying holdings across the proposition have either stable or positive momentum.

Impact Statistics

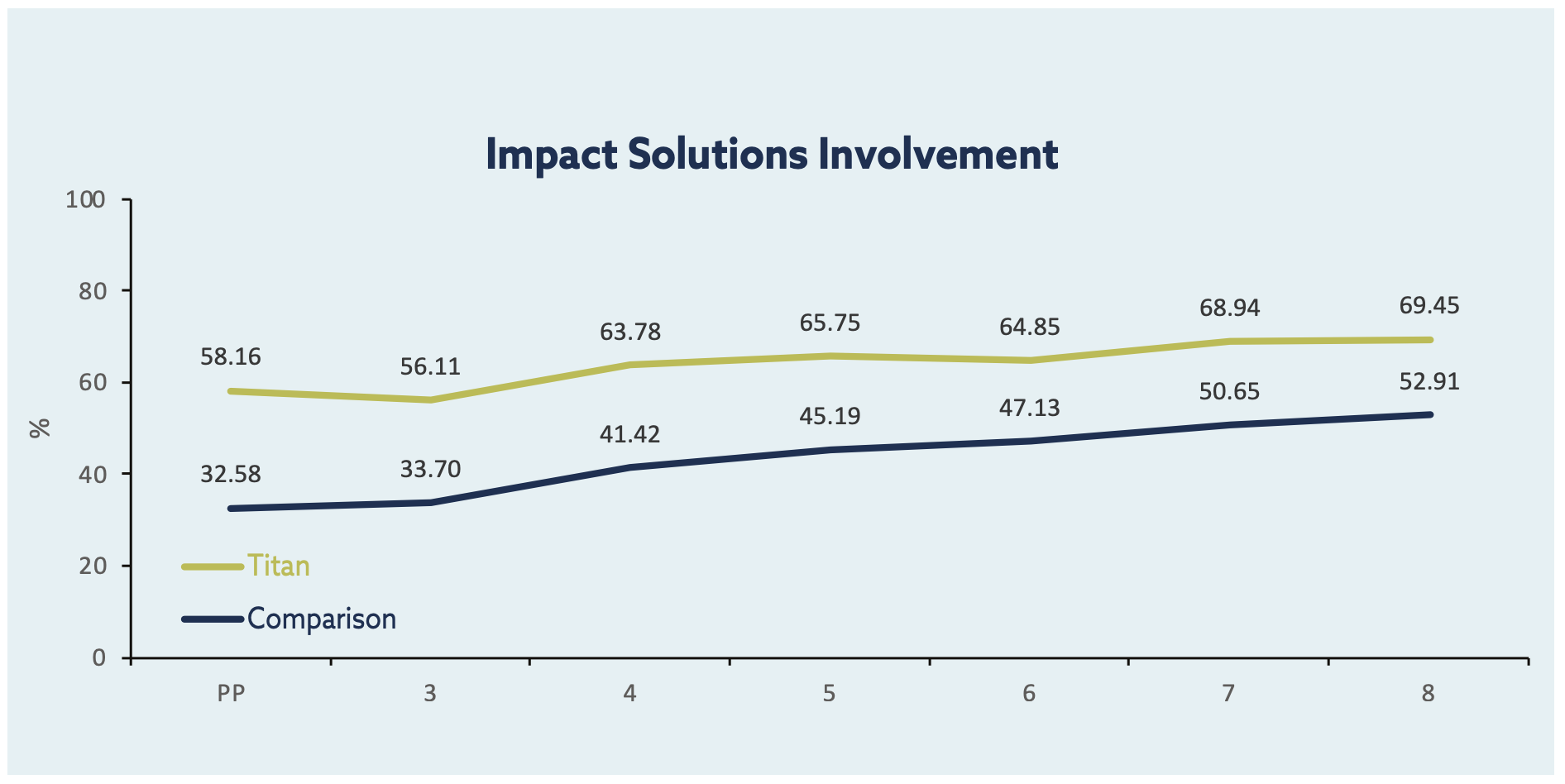

The purpose of this section is to measure and explore the positive impact achieved by the proposition, excluding sovereign exposure. As we explained earlier in the report, impact can be measured across a range of sustainability solutions, like alternative energy or affordable real estate. Although our proposition does not follow a dual mandate (risk / return plus impact), it is still possible to determine whether or not our investments are achieving any positive impact. Looking at the charts in this section, we can see that the proposition achieves a considerable positive impact.

Impact Solutions Involvement

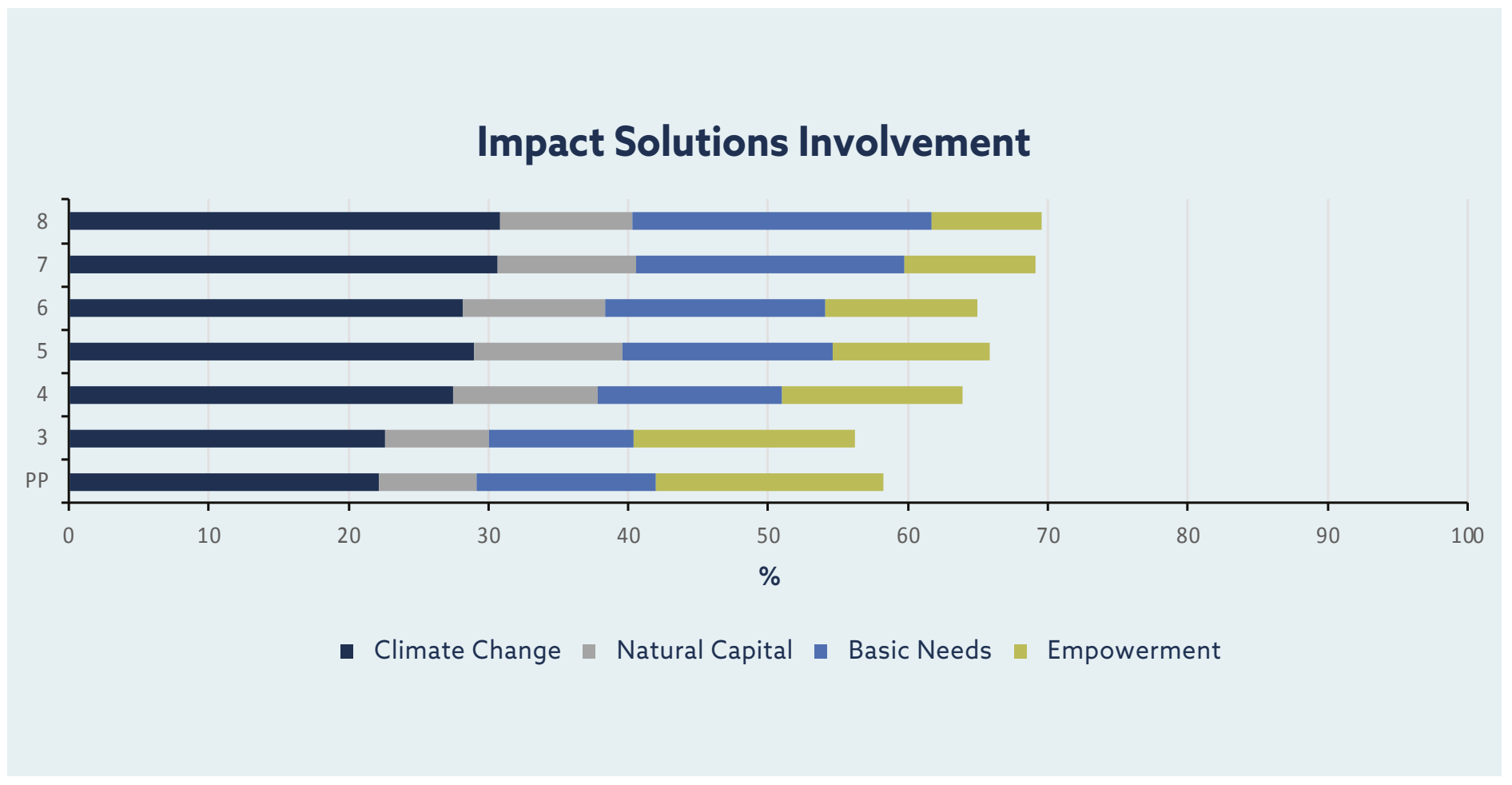

The aggregated figure represents the full market value exposure to a range of impact solutions, which we can map from Theme (e.g. alternative energy) to Category (e.g. climate change) to UN SDG (e.g. climate action). If we compare the green line, our proposition, to the blue line, the market comparison, we see that our proposition achieves more from an impact POV.

Looking at the stacked bar chart, we can see that the proposition has the most exposure to companies providing climate change solutions.

Risk Statistics

The purpose of this section is to measure and explore the material ESG risk of the proposition, excluding sovereign exposure. Looking at the charts in this section, we can see that the proposition is far less exposed to material ESG risk than the market comparison.

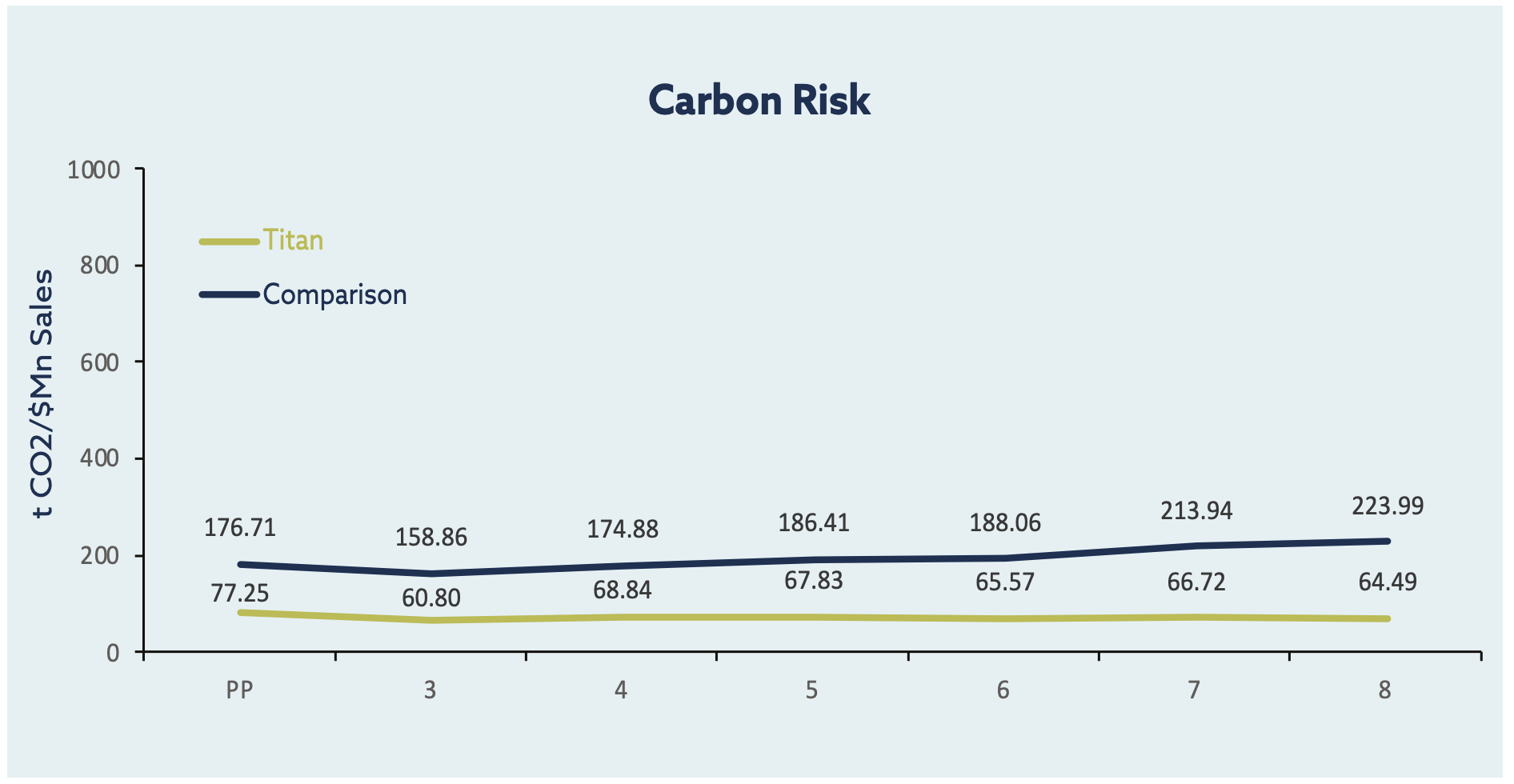

Carbon Risk

Companies which emit lots of carbon dioxide (CO2) are more exposed to carbon-related market and regulatory risks that arise due to climate change. We approximate carbon risk by measuring the carbon intensity of each fund in the proposition, which is the direct plus indirect CO2 emissions of the underlying holdings, divided by sales. Comparing the green line with the blue line, we can see that the carbon risk of the proposition is significantly less than that of the market comparison (the lower the intensity, the better).

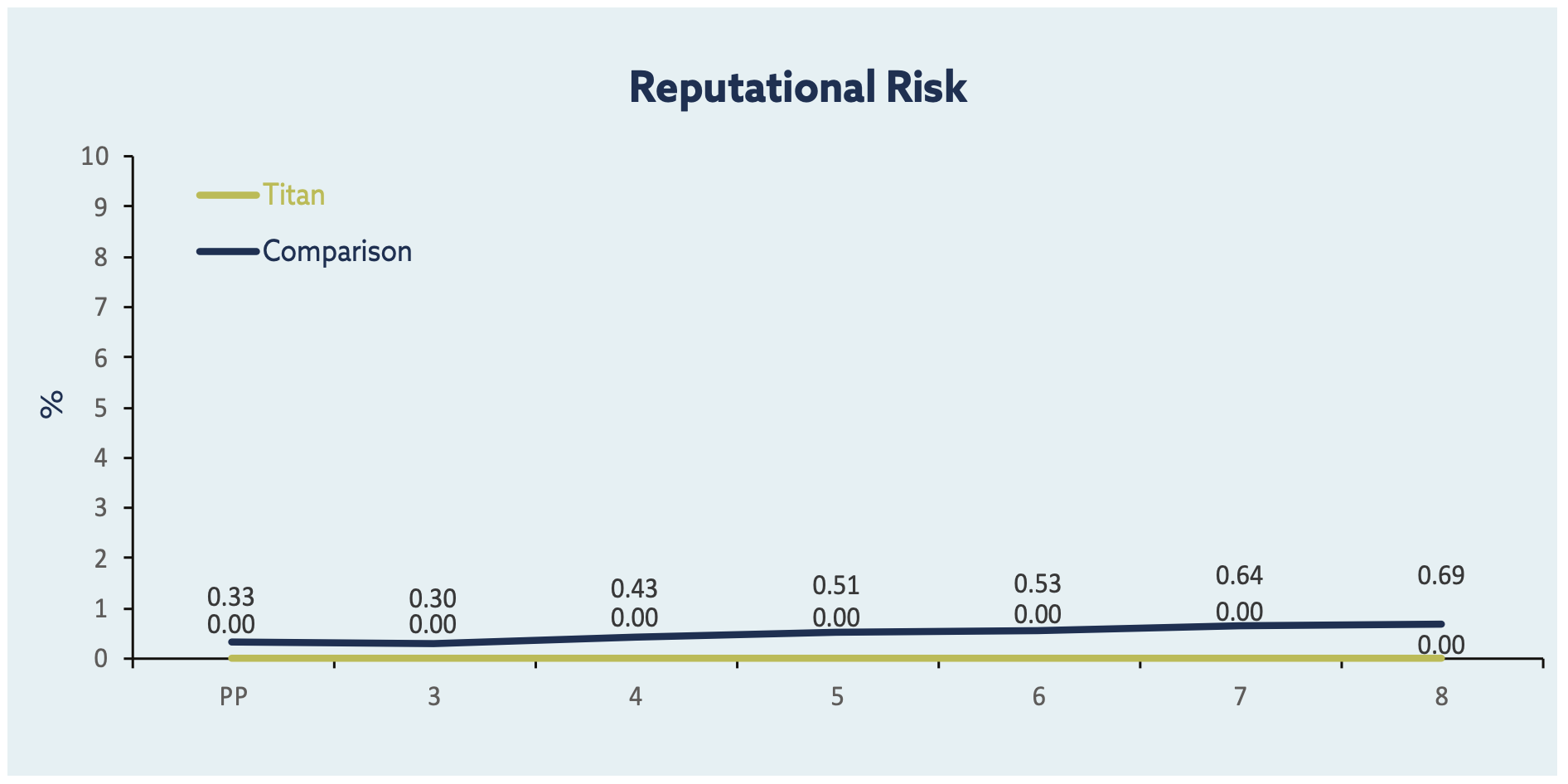

Reputational Risk

Reputational risk measures exposure to companies that have caused or been involved in significant ESG controversies. There are 28 types of controversy; examples include operational waste, human rights abuse, and bribery. The proposition has no exposure to companies involved in ESG controversies, unlike the market comparison, which on average has about 0.5% exposure (the lower the risk, the better).

Corporate Governance Risk

Corporate governance risk is split into the following categories: laggards, average, leaders (worst to best). Almost all of the underlying holdings across the proposition are classified as average or leaders.

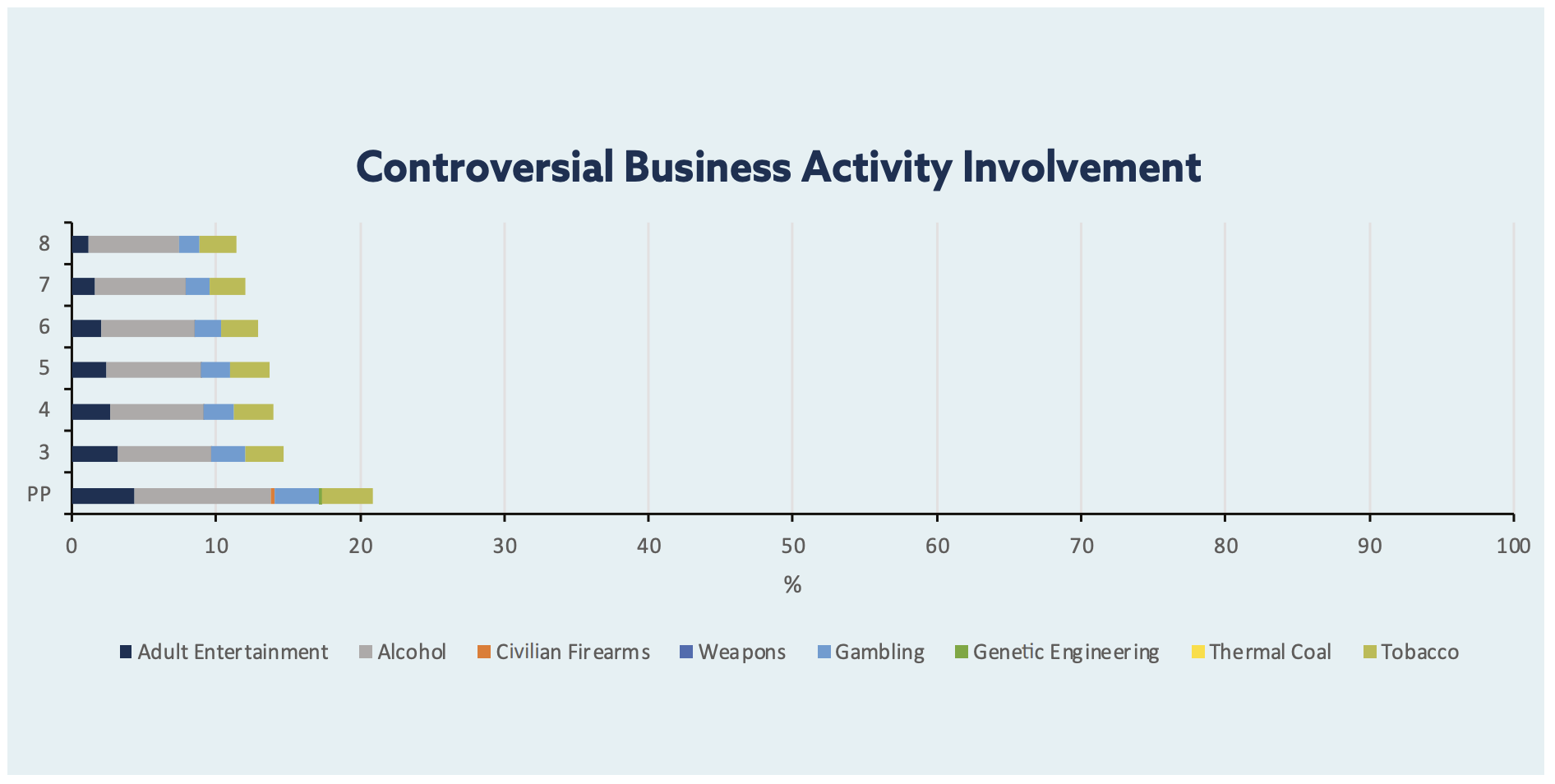

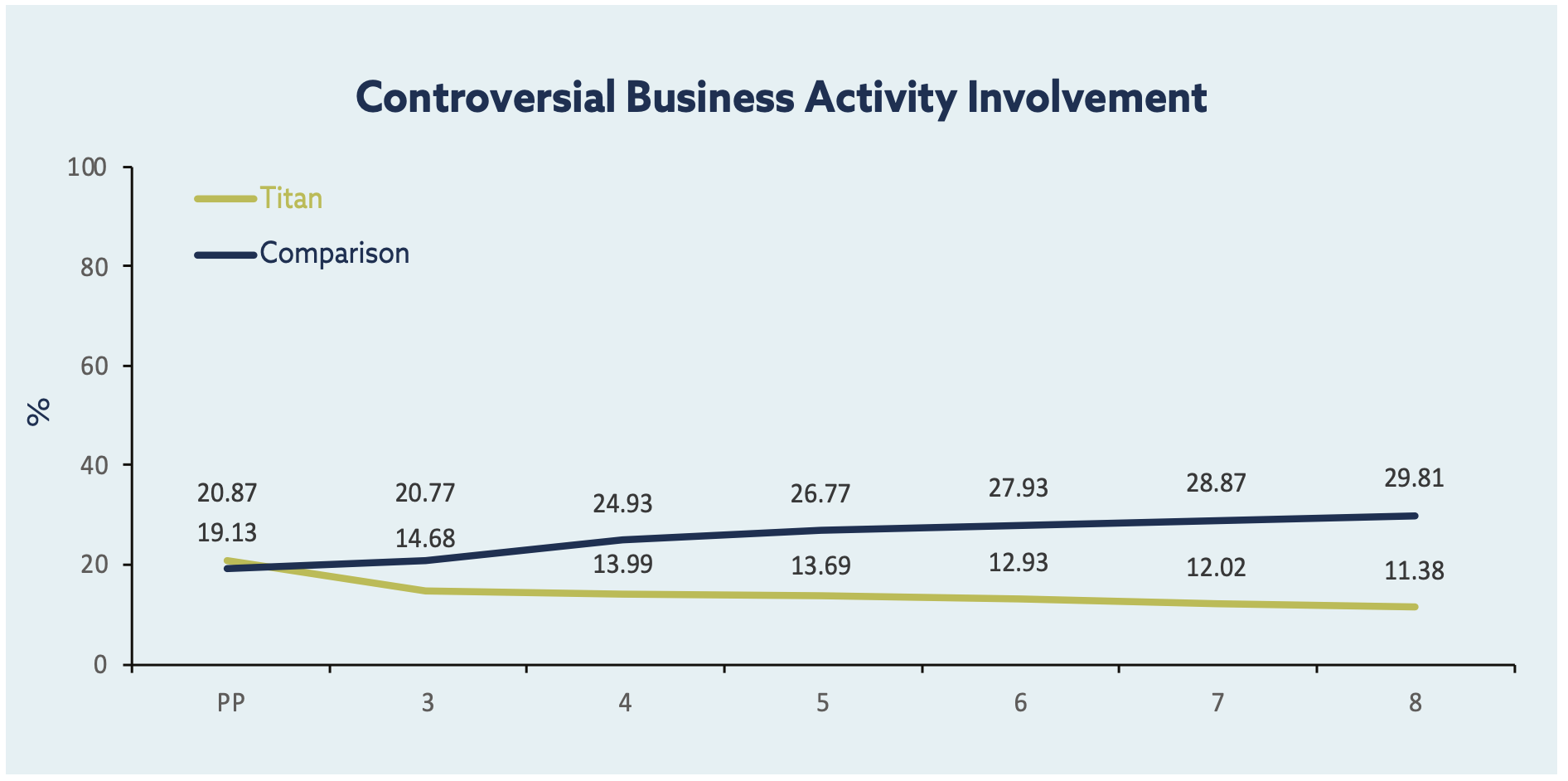

Controversial Business Activity Involvement

The aggregated figure represents the full market value exposure to a range of controversial business activities: adult entertainment, alcohol, civilian firearms, weapons, gambling, genetic engineering, thermal coal, tobacco. If we compare the green line, our proposition, to the blue line, the market comparison, we see that the proposition is less exposed to a range of controversial business activities than the market comparison (the lower the figure, the better).

Looking at the stacked bar chart, we can see that the proposition has the most exposure to companies with a tie to the production and distribution of alcohol; exposure to alcohol per fund is, on average, 7%.