Our approach

The market cycle

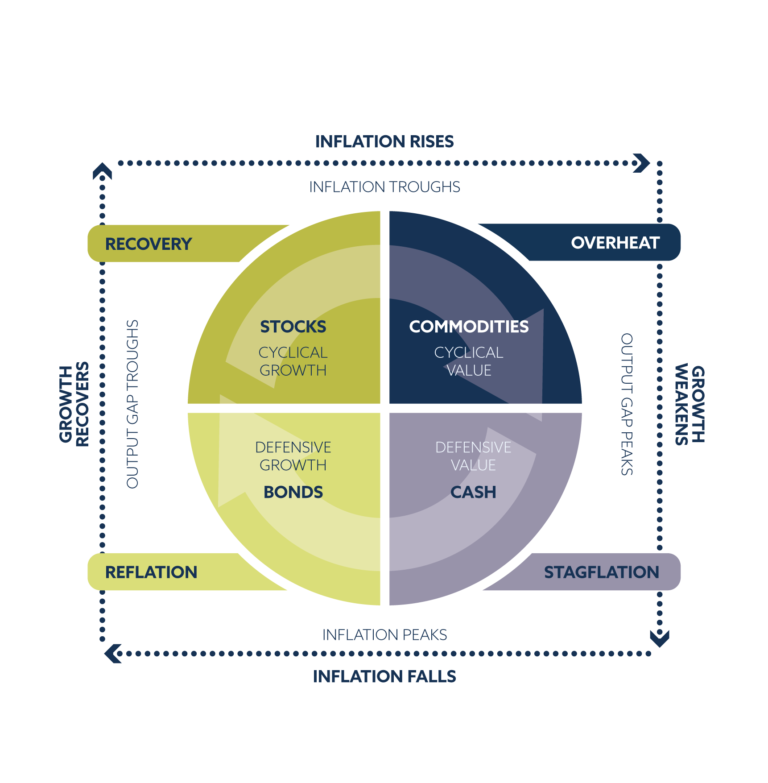

One cornerstone of our approach to investing is the market cycle. Understanding how cycles work over time allows us to adjust our exposure to maximise the probability that our investments work for our clients. Economies and markets are subject to cyclical patterns over time. These cycles aren’t quite clockwork but subject to a variety of economic factors and human psychology. There is a phrase that ‘history does not repeat itself, but it does rhyme’ and by paying attention to such rhythms we can learn from the past and apply these lessons to the present.

These cycles manifest themselves in the collective action of market participants.

One such example is the relative performance of US cyclical stocks (those most geared to the economy) versus US defensive stocks (those most insulated from the economic cycle) which have oscillated within a clearly defined range for the last 3 decades. Referencing the diagram above, investors tend to prefer cyclical stocks during expansionary periods and defensive stocks during recessions. This is consistent with the fact the peaks and troughs in the cyclicals:defensives ratio aligns perfectly with the highs and lows of the S&P 500 equity index over time as shown by the log-linear chart in the bottom panel.

The key takeaway from this chart, other than the clear cyclical nature of the relationship over time, are the points at which the marginal buyer, or seller, determines that the ratio has reached an extreme. These levels are driven by human psychology, which are represented visually on the chart by the yellow lines.

Similarly, our emerging market equity rotation model highlights a staggering cyclicality between the relative performance of Chinese, and emerging market equities excluding China, over time. This is represented by the blue and white lines below which are, in effect, mirror images of each other over time.

Commodities are nothing if not cyclical. They rise and fall with remarkable consistency over time. The mechanism through which this cycle operates is supply and demand. If supply falls, prices rise, bringing commodity producers on-line thereby increasing supply and reducing prices … and so on. Commodities do not exist in isolation, but this relationship is nicely represented in the chart below which shows the year-on-year percentage change in the S&P Goldman Sachs Commodity Index, which is a broad-basket of major commodity futures rolled into one composite index.

The cyclical low in each wave is demonstrated by the arcs at the bottom of the chart.

To help manage our commodity exposure over time, which can be a key source of differentiated return versus a traditional 60:40 portfolio, we use the gold/oil ratio. Since 1997, there have been four phases where this ratio has risen noticeably. These phases are identified by the circles which represent the dot-com bubble, sub-prime mortgage crisis, eurozone slowdown and Covid crisis.

The first circle in each phase represents peak-inflationary-optimism… the “pride before the fall”. The second circle in each phase represents peak-deflationary-pessimism… that “down and out” feeling you get at market bottoms. In each instance, when moving from the first circle to the second, gold has outperformed oil as fear rises and risk aversion sets in. Moving past the second circle represents renewed optimism as markets price in economic recovery.

The key takeaway from this chart is that the first circle in each cycle has consistently flagged a peak in commodity prices whereas the second circle has consistently flagged the bottom in commodity markets in each of the last four phases. We believe we are now moving from the first to the second circle in a new cycle.

Investing isn’t about predicting the future. It’s about recognising the position in the cycle and adjusting as required to stack the odds in your favour. This market cycle approach to top-down global macro investing helps inform our core investment outlook which we implement across our fund and model portfolio range in accordance with our investment process.