I want to begin this blog by firstly taking time to explain why foreign exchange is an important part of portfolio composition and why as investors you should be paying close attention to currency exposure, as it could be driving or eroding your investment returns.

When investing in most globally diversified portfolios investors need to consider not only the risk of the underlying investment, but also the risk of the investable currency. For example, when you invest in the S&P 500 Index as a GBP based investor you have to convert your GBP into USD. However, when looking to cash in the investment you will once again need to swap those USD back into your base currency of GBP. In doing so you have left yourself exposed to the currency moves throughout the period. If USD depreciates it will buy you less GBP, eating away at your total return.

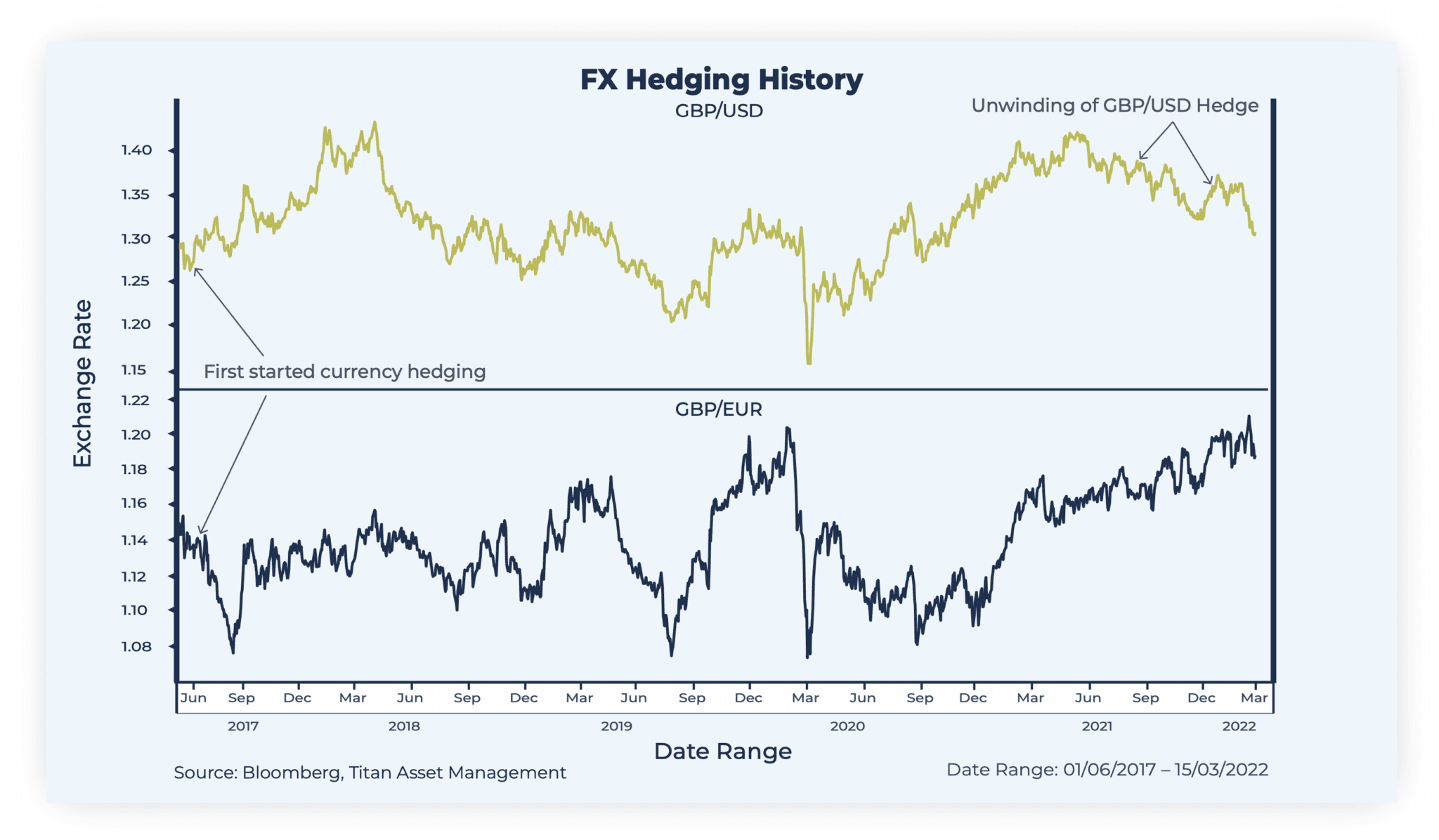

To combat these currency moves we began our currency overlay strategy in June of 2017, applying a blanket strategy to all of our ACUMEN portfolios by hedging all equity and fixed income USD and EUR underlying exposure via FX derivatives.

We did so to reduce risk relative to our currency hedged market composite benchmark and because we viewed GBP as deeply undervalued as depicted by purchasing power parity. As shown in the graph above, both hedges have done well insulating the ACUMEN portfolios from both EUR and USD depreciation against GBP in the long term.

Following our strategic review in 2020, we decided to move from a passive to an active currency management strategy, capitalizing on shorter-term tactical market opportunities highlighted by technical analysis and verified by fundamental reasoning. This decision came as we moved from the aforementioned market composite benchmark to IA sectors comprising funds that tend to leave the majority of their equity based currency exposure unhedged.

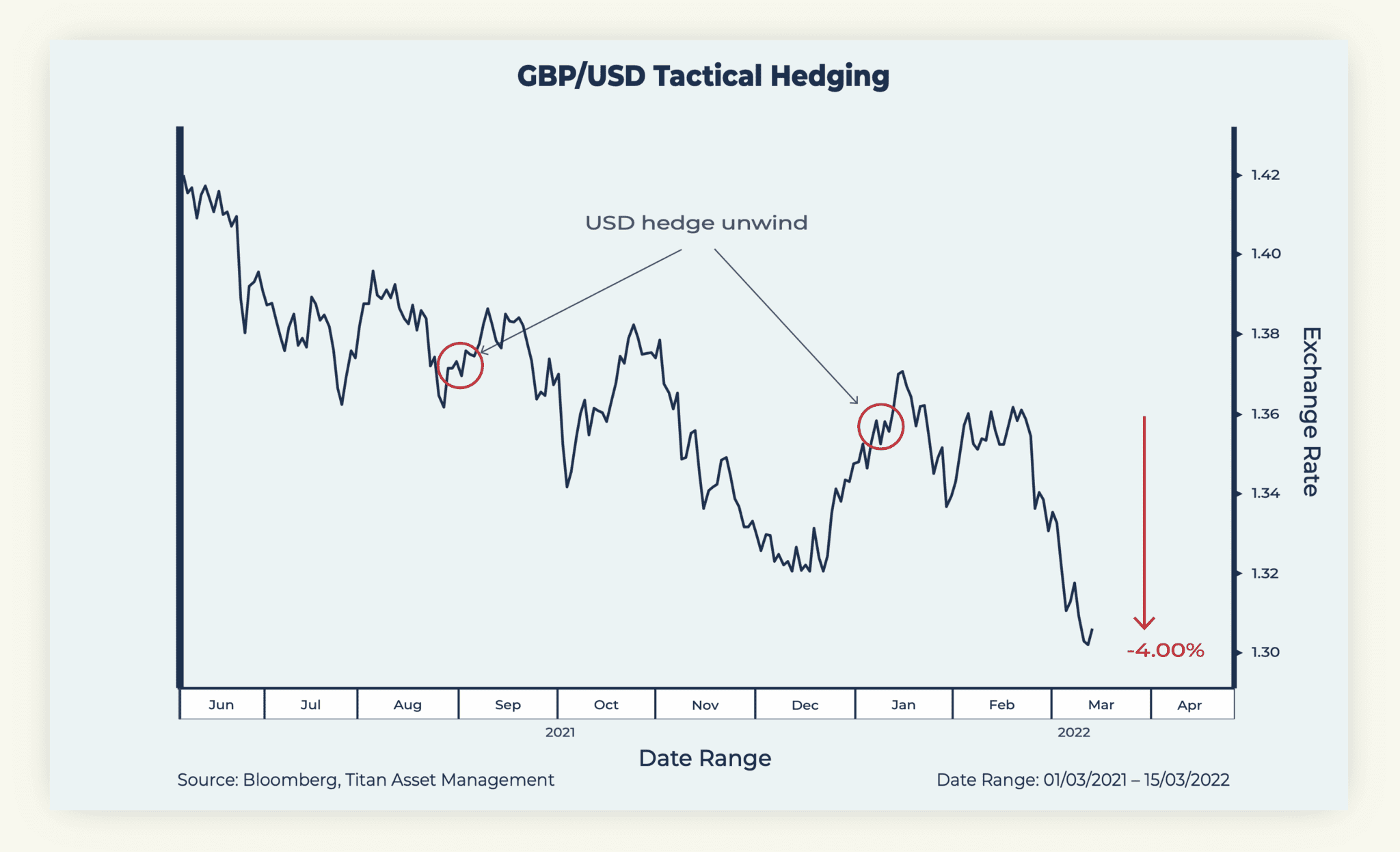

That said, given our market outlook at the time, we did not immediately adjust our exposure and instead opted to retain our existing currency hedges. This meant we participated in much of the earlier rally in GBP/USD to 1.42.

Following a technical pull-back, a shift in risk appetite and growing concerns over inflation and lofty equity valuations we decided to unwind 70% of our equity and commodity-linked USD currency exposure in August 2021 at around 1.37, whilst retaining our euro hedge. As our conviction in the trade grew and deteriorating risk appetite materialized we then decided to unwind an additional 15% USD exposure in early January at 1.36.

The result: over 4% appreciation in USD (GBP/USD currently at 1.30) and further EUR hedge gains translating to improved fund performance that goes straight to the investors’ bottom line. This goes to show the importance of active management, especially in recent volatile times.

FOMO in the death zone

This weekend I watched Top Gun 2. Good movie, nothing on the original, but a great soundtrack, specifically the Kenny Loggins song: […]