It’s been a volatile start to 2022. For the last two-ish years, markets have enjoyed a buy-the-dip mentality as pro-growth fiscal and ultra-accommodative monetary policies have kept the show on the road. However, with the new year came a renewed sense that this narrative may be coming to an end. Central banks are turning increasingly hawkish, in response to high and persistent inflation, and prior fiscal tailwinds (2021 was the biggest expansion of fiscal policy in history) are now turning to headwinds. As a result, investors have started taking profits, particularly in expensive sub-sectors like tech.

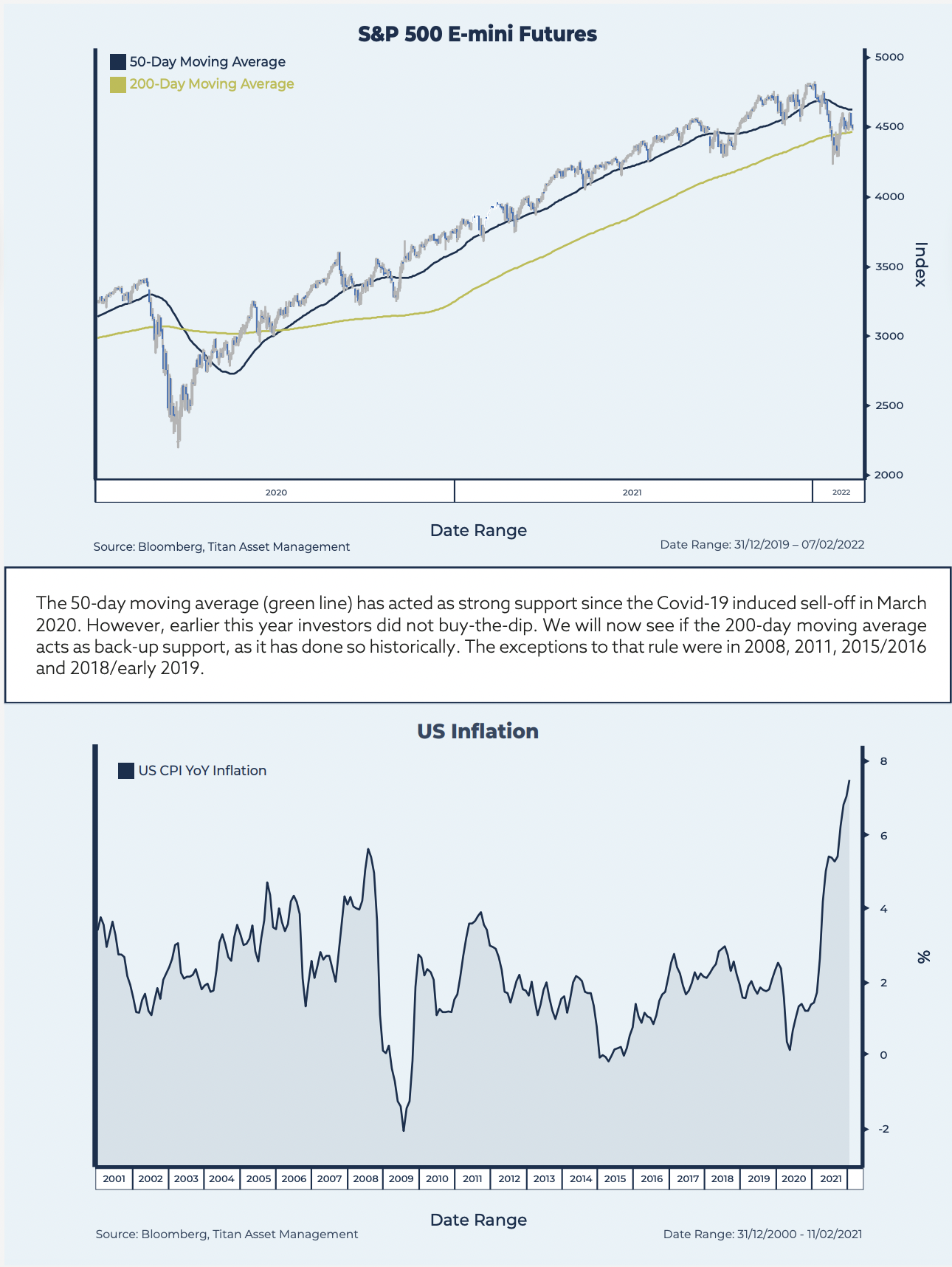

This is demonstrated in the chart below, which shows the performance of S&P 500 futures.

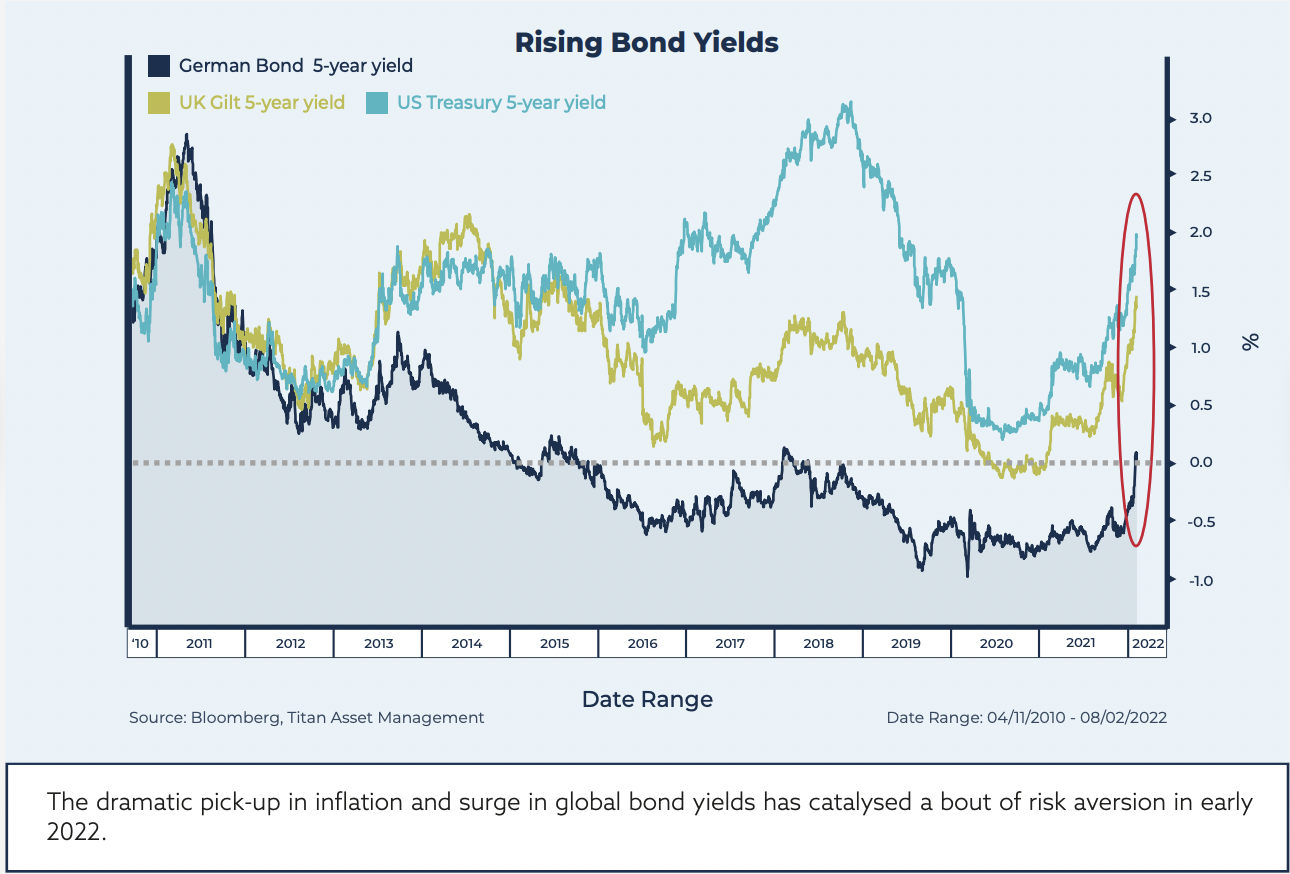

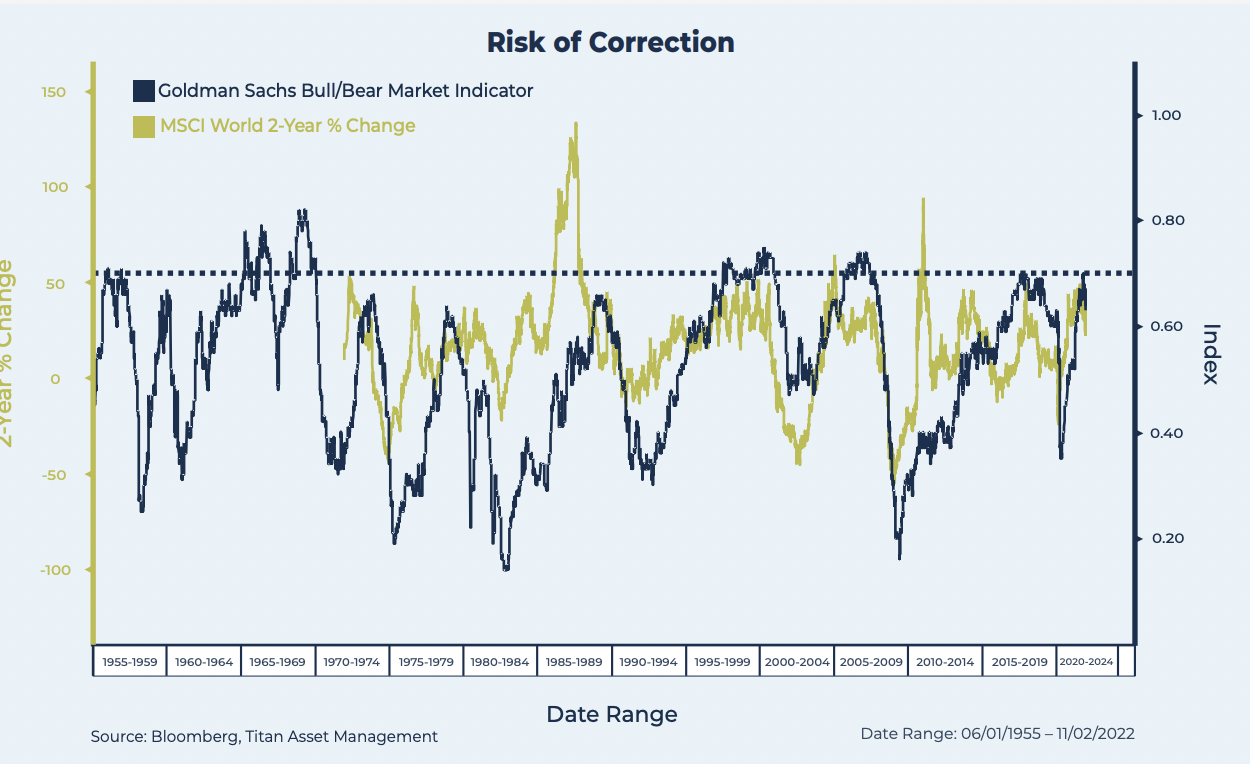

This doesn’t come as a huge surprise. We wrote about the growing risks to asset price valuations in our Q4 Quarterly Perspectives document. The next chart is taken from our Q1 2022 Quarterly Perspectives. It shows the Goldman Sachs Bull/Bear market indicator, which has a good track record for flagging market tops, and as you can see, we are now in the danger zone.

Markets don’t go up forever and given the run we’ve been on, some kind of market correction was inevitable. However, it is important to remember that, strategically, the underlying economy remains strong (GDP accelerated at 6.9% annualised rate in Q4) and we think this can continue, as Covid-19 fades into the spring and summer months, so long as central banks do not over tighten. One of our key themes is inflation will likely peak this year (as base effects kick-in and the temporary acyclical factors driving today’s surge eventually dissipate through 2022) but remain elevated by historical standards.

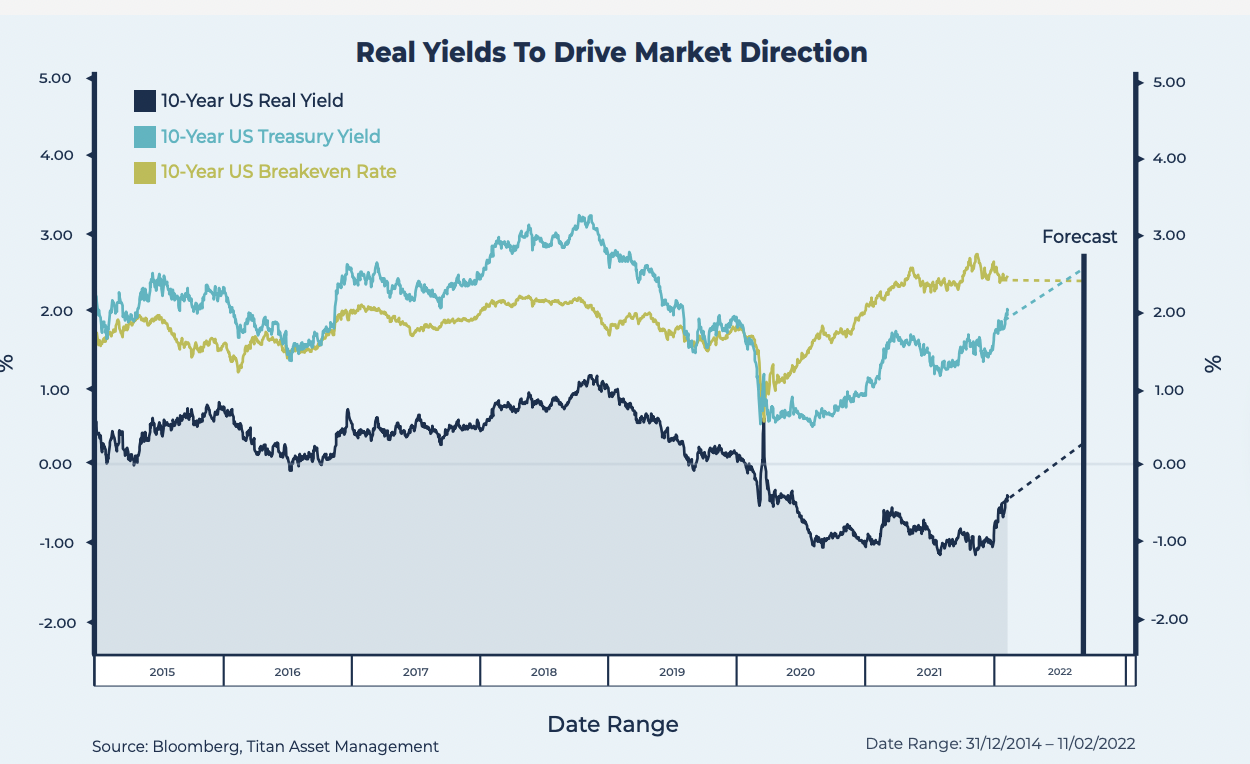

In the next chart we have modelled our base case scenario which shows a pick-up in nominal bond yields (in light blue) whilst inflation expectations (in green) remain broadly stable, causing real yields (in blue) to move out of negative territory.

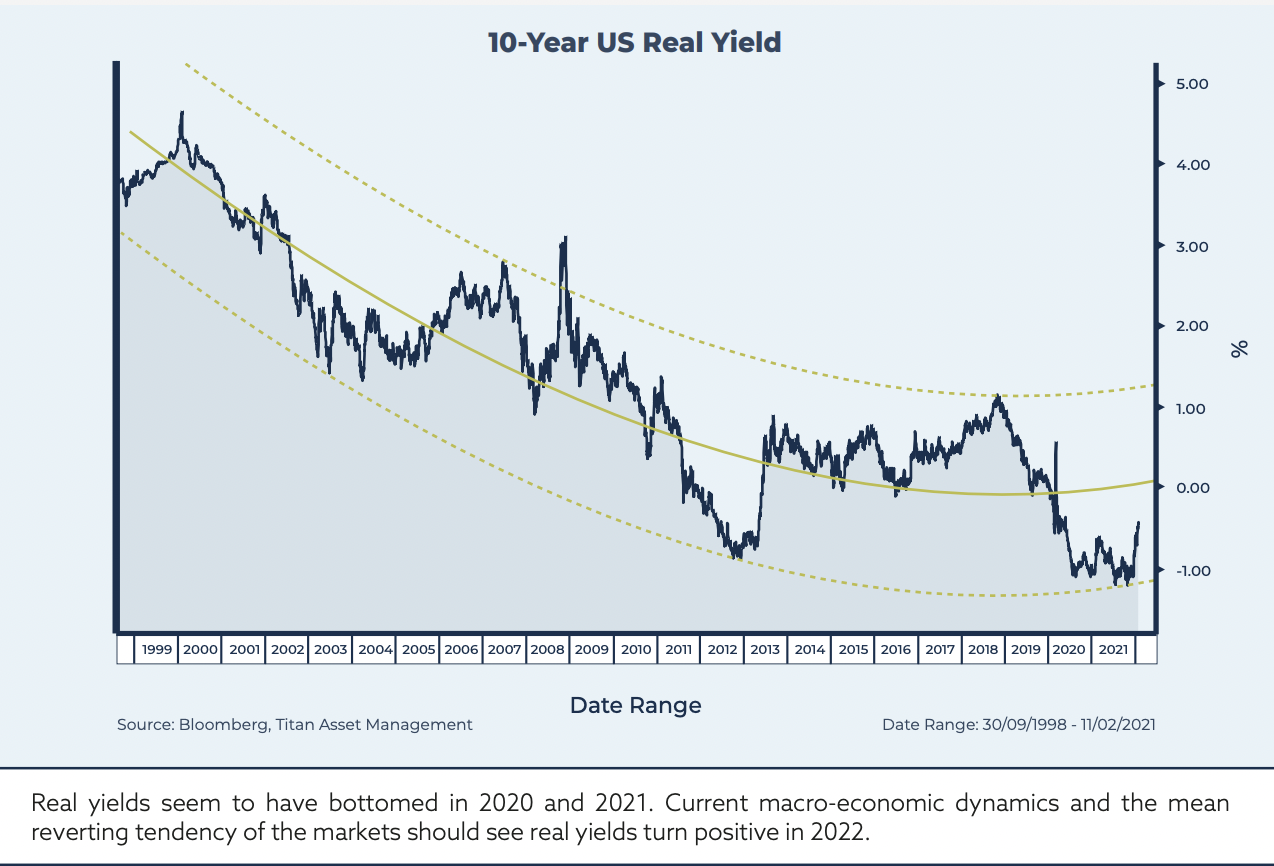

The above chart may seem overly technical and forecasting anything on a short-term basis can be tricky, but we do think the direction of travel is up and the following chart demonstrates that quite nicely by giving this outlook some sense of historical perspective.

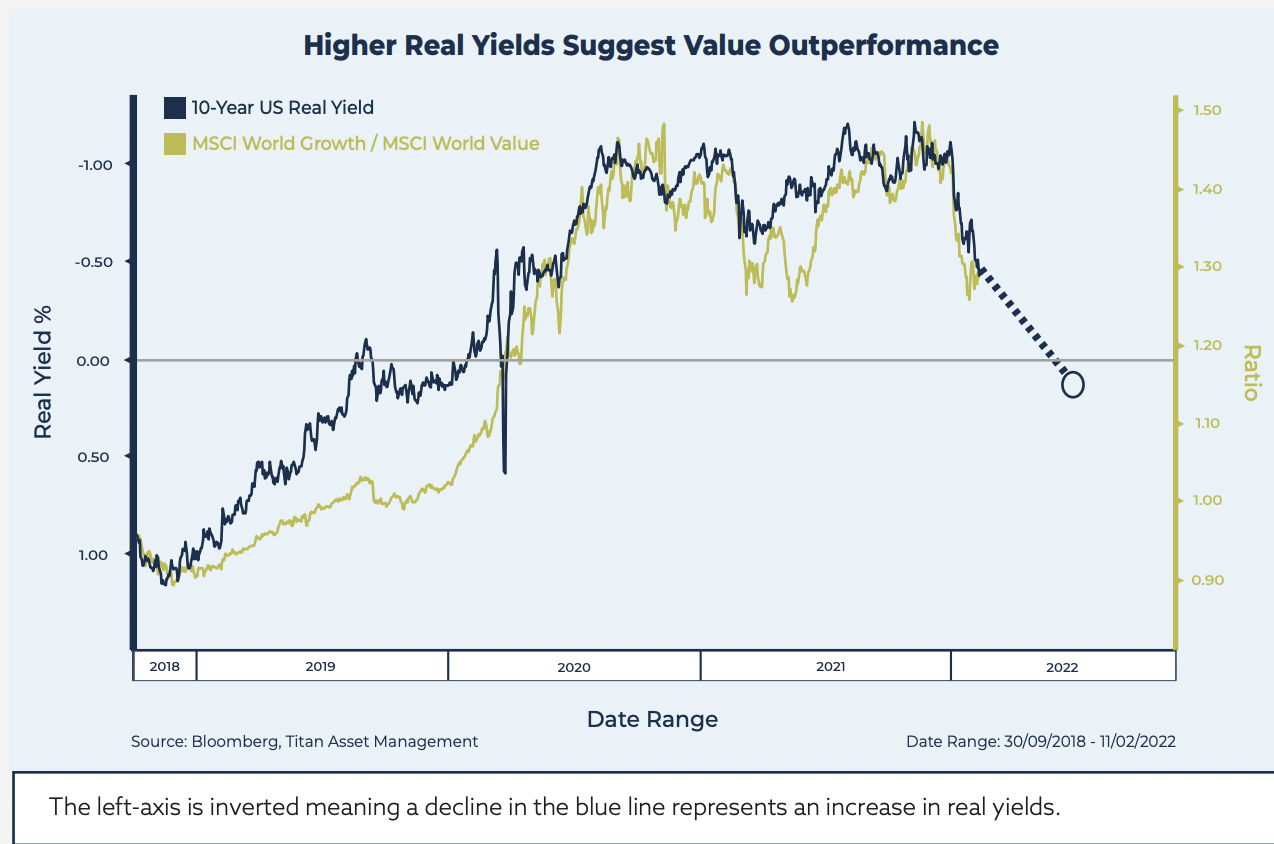

Real yields are a key driver for a whole host of different markets. One such relationship is demonstrated in the chart below which shows the strong correlation with the growth/value equity ratio (in green). If the above forecast holds true, we should see value stocks outperform growth this year.

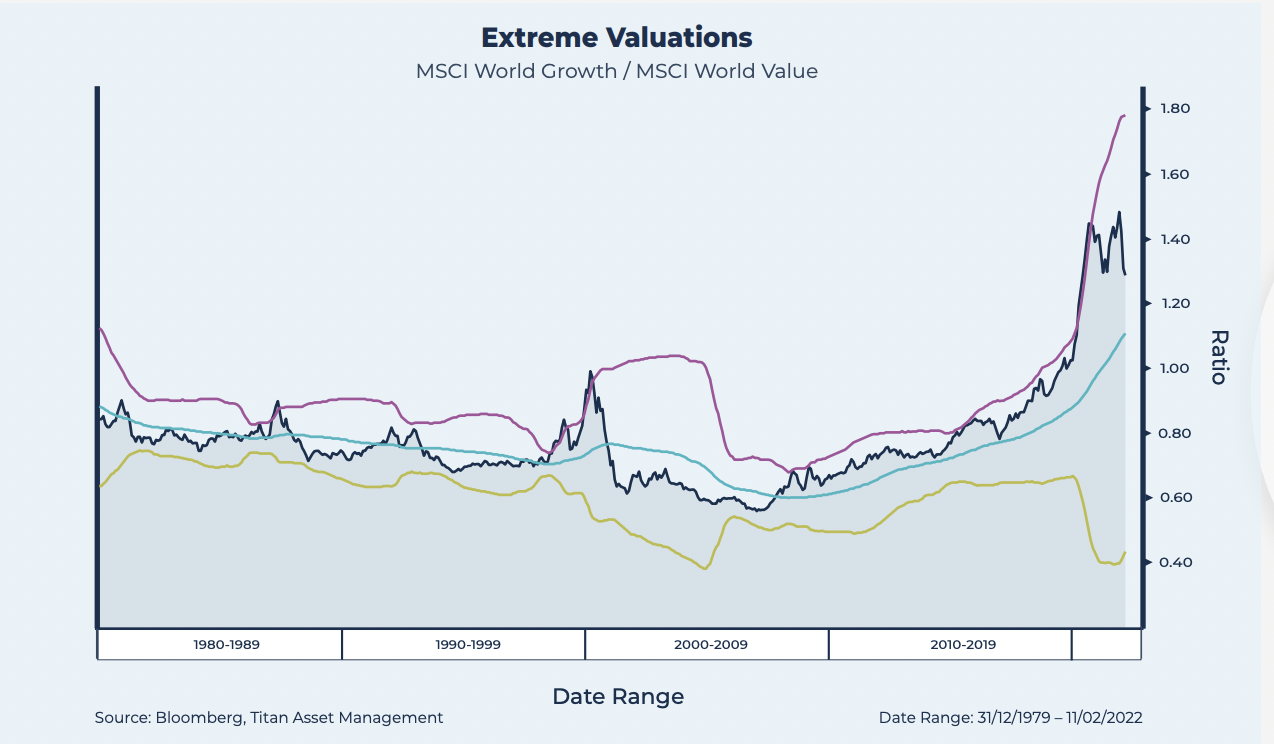

If we zoom out slightly, this is consistent with prior occasions the growth/value ratio has reached prior extremes, denoted by a breach of the 3 standard deviation Bollinger band encompassing the ratio (purple and green lines). There are two main observations from this chart. Firstly, prior such occasions (mid-1980s, dotcom bubble and the corona crisis) have typically seen the value/growth ratio mean revert and overshoot when doing so, suggesting strong upside potential, and second, the sheer magnitude of the prior run, which dwarfed the dot-com bubble.

So, what does all this mean?

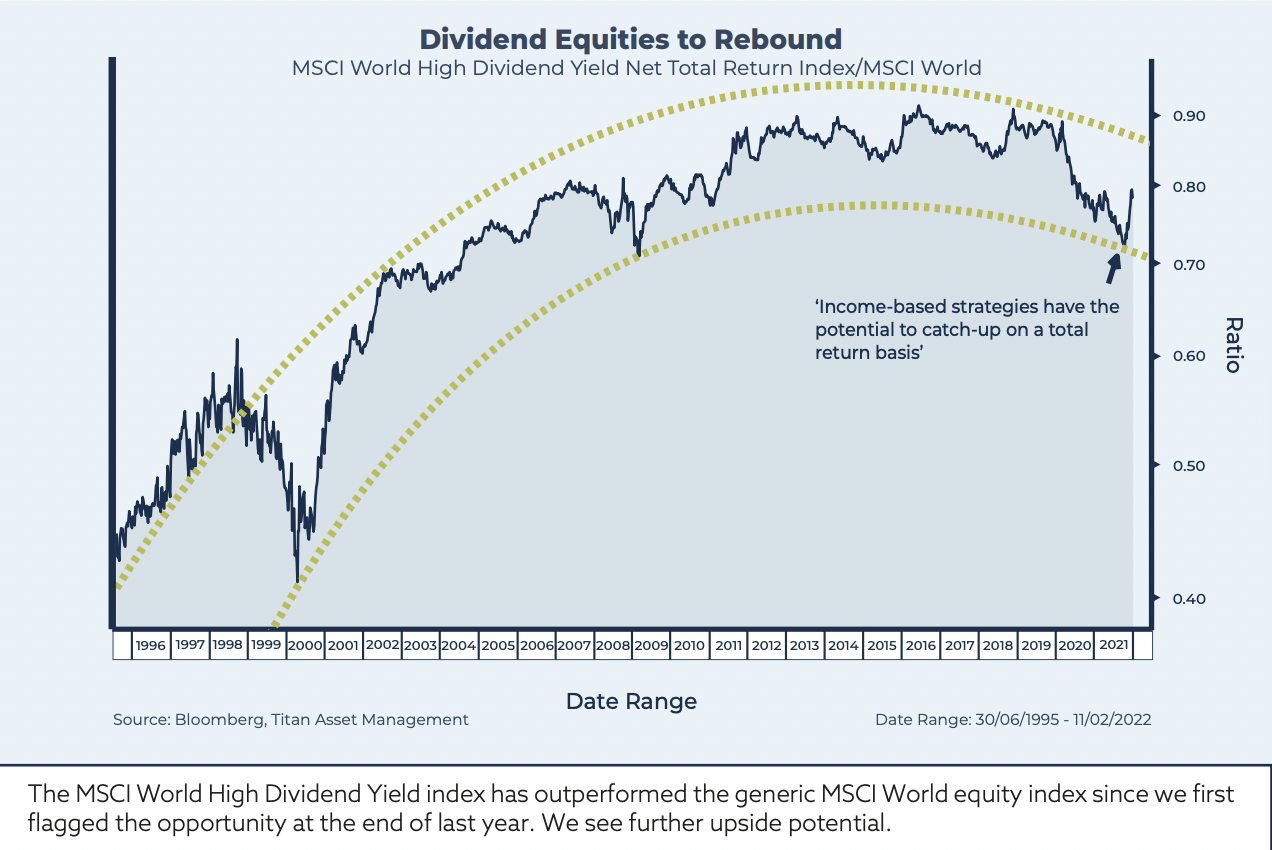

Overall, we remain constructive on equities over bonds with a preference for cyclical and value stocks. We also like commodities and commodity-linked equities which benefit from favourable supply/demand dynamics and tend to perform well in inflationary environments. As equities look set to outperform fixed income in the inflationary environment laid out ahead, asset allocators are incentivised to look to dividends and high dividend stocks as a source of income over the coupons generated from bonds. Furthermore, from a historical perspective, dividend paying strategies have tended to outperform late cycle and if inflation does persist, then the best place to be is in those companies positioned to benefit from rising rates that have pricing power and can deliver dividends. One theme that ticks all those boxes is dividend-paying European and UK equities which have lagged their US peers and offer the potential for catch-up gains on a total return basis.

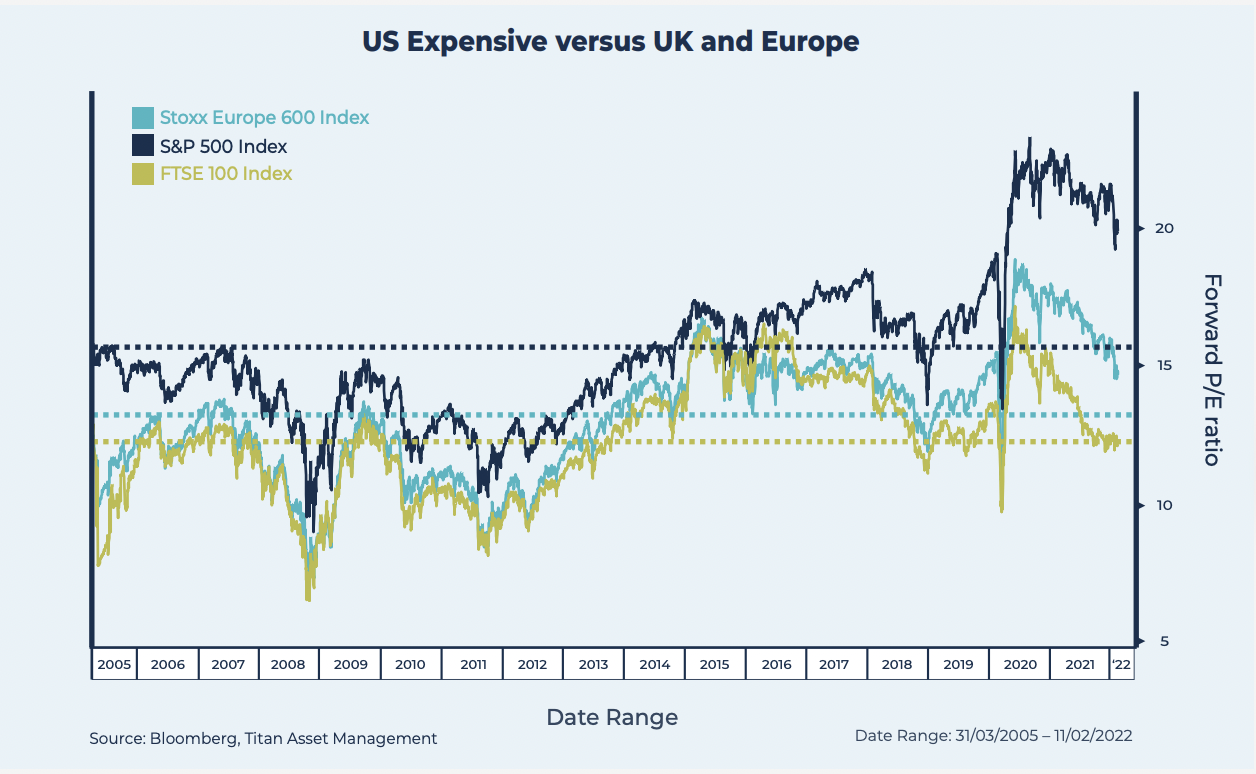

Europe and the UK trade at a historically relevant discount to US equities which are expensive and vulnerable to higher real interest rates. They are cyclical economies skewed towards old world sectors of the economy, such as financials and energy, which have historically paid attractive dividends to investors, with leveraged exposure to the global economy. Europe in particular has elevated exposure to China where we think peak pessimism is priced-in. Recent steps taken by the Chinese Communist Party to bolster growth and the expected pick-up in the credit impulse should provide additional tailwinds this year.

We have implemented these themes across the multi-asset class ACUMEN Income Portfolio and MPS

Income 6, both of which have outperformed YTD. We have also taken steps to pivot ACUMEN Portfolios 3-8 in the same direction via new positions in dividend-paying UK and European equity ETFs.

Technically, UK dividend stocks have just broken out of their 8-year downtrend versus the MSCI World equity index.

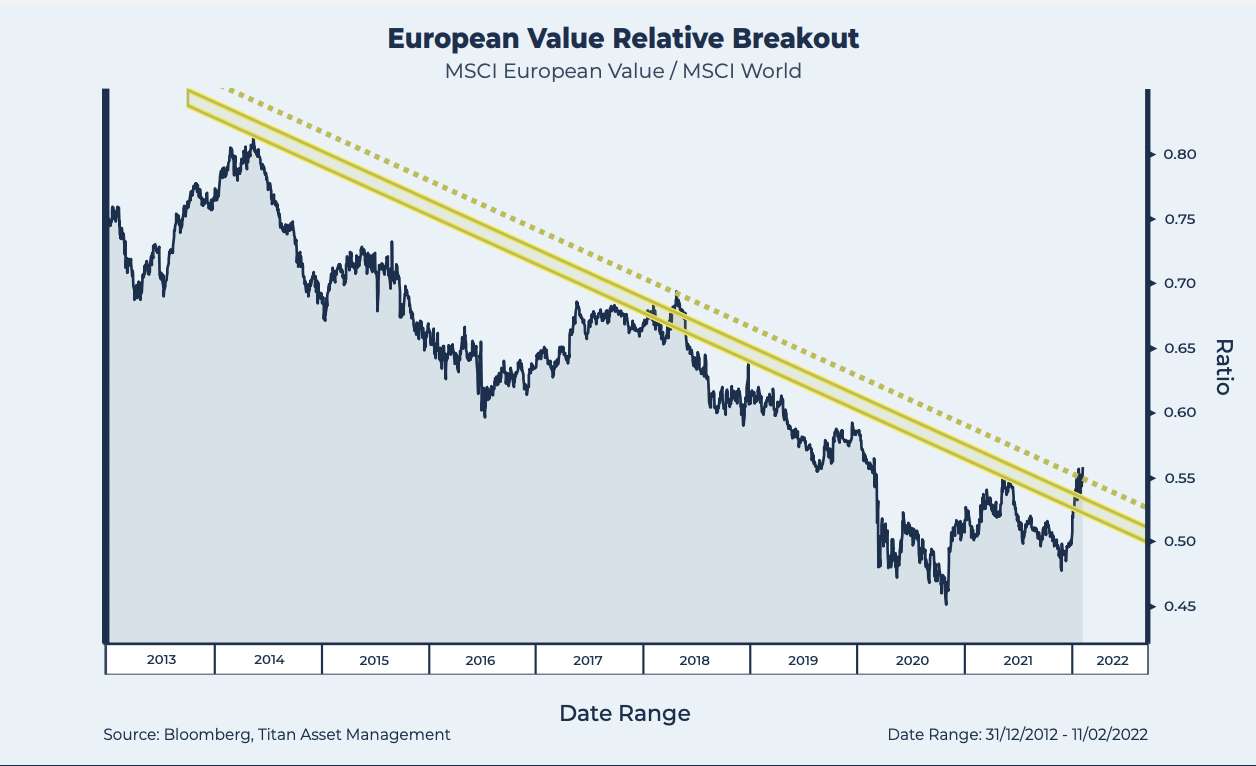

European value stocks, which also offer an attractive dividend yield, have also just broken out of their own long-term downtrend. What is particularly encouraging is that despite the strength of recent gains, the ratio has held firm above prior resistance and seems to be moving upwards again, suggesting further upside potential.

In conclusion…

I wanted to finish off with a bit of housekeeping and a few words on the team. Many of you may be anxious about recent events and I think at times like this it makes sense to ratchet-up the communication. The regular monthly update call will remain but we will now introduce a shorter bi-weekly update which will be more Q&A focused. We had our first this week and the feedback was very positive. You will also be hearing more from the rest of the team who have enjoyed a number of successful achievements over the last few months. Andrew Pottie, senior fixed income portfolio manager now holds the CFA charter which is a significant milestone in his career to date.

Further, Sekar Indran, senior equity portfolio manager, and James Peel, ESG portfolio manager, recently passed their CFA level 3 exams. Alex Livingstone and Jonah Levy passed their level 2 exams last year and will be progressing towards completion in 2022. As such, you will also be receiving regular updates authored by each member of the team via a series of regular, short, asset class specific blogs. I also want to start a series of snappy videos summarising our key views, to accompany these blogs, that I intend to post on social media.

John Leiper, CIO on CNBC 23rd February with Stephen Sedgwick and Karen Tso

Today, 23rd February, Titan Asset Management CIO, John Leiper, CFA, FDP, CFTe appeared on CNBC this morning with Stephen Sedgwick and Karen Tso. Leiper discussed the AI frenzy, and what […]