SUSTAINABLE INVESTING

The purpose of this section is to introduce sustainable investing and, importantly, explain our approach to sustainable investing.

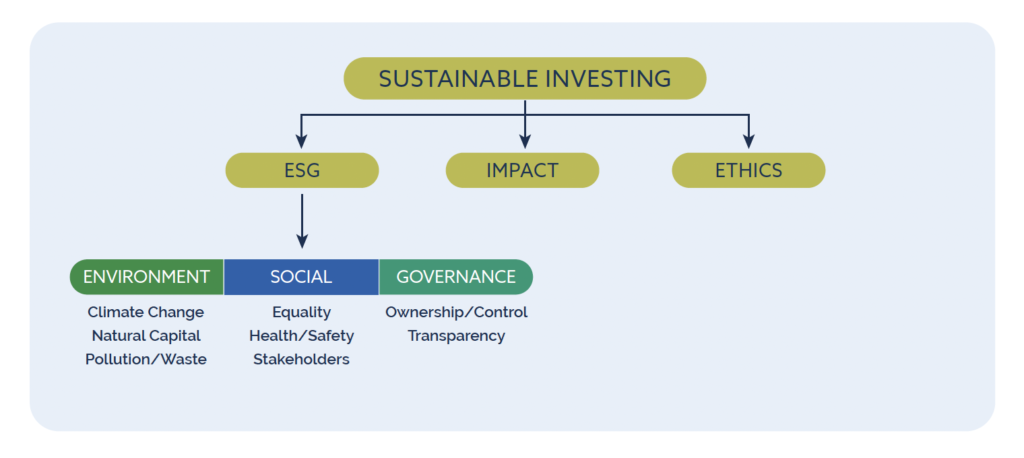

In 1987 sustainable development was defined by the United Nations as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” This definition is widely recognisable because it is still taught in classrooms today and is the theoretical foundation upon which sustainable investing builds. Our definition of sustainable investing is: a holistic approach to investing which widens the focus of investors by integrating sustainability considerations alongside the traditional focus of investors, risk-adjusted return. It comes in many shapes and sizes but can be distilled into three primary pillars: environmental, social, governance (ESG), impact and ethics. For the avoidance of doubt, our definition of sustainable investing is our own and should not be considered as fact.

ESG is the integration of material non-financial data into the risk management process; the reason being, integrating more material data can improve the process and so can improve risk-adjusted returns. Examples of non-financial data include: greenhouse gas emissions, employee diversity, financial reporting quality. The outcome of this integration might be to prioritise or reduce exposure to certain geographies or sectors or companies. ESG leaders (those prioritised) and laggards (those reduced) can be identified in several ways. First, by using non-financial data, perhaps a third party ESG score, to identify geographies, sectors or companies that appreciate the necessity of the transition to a more sustainability-minded planet and are adapting their strategies accordingly. We call this basket of leaders adjusters (for example, Microsoft). Second, we can use traditional analysis techniques to identify sectors or companies that are either innovating at the cutting edge of this transition or are enabling those that are doing the innovating. There are two baskets here: the innovators (for example, Tesla) and the enablers (for example, SSE).

Impact is an explicit statement of sustainability targets separate to risk-adjusted return. Examples of these targets, which could be environmental or social in nature, include: reducing greenhouse gas emissions in-line with the Paris Agreement, or improving gender and racial diversity at the board or company level. Consequently, investors structure their portfolios to achieve this dual mandate.

Ethics, or ethical investing, is the integration of an investor’s moral or religious beliefs into the portfolio construction process. It is the oldest of the three pillars of sustainable investing, and can trace its roots back to Shariah, the religious law of Islam, and to religious groups that prohibited members from participating in the slave trade. A more modern interpretation might be to exclude tobacco or firearms from an investable universe. For the avoidance of doubt, we do not explicitly screen out any controversial activities from our investable universe.

The purpose of our sustainable investment policy is to separate our investable universe into opportunities that do represent a sustainable allocation of capital and those that do not. This approach means that, across our sustainable investment proposition, we have exposure to all three of the pillars that constitute sustainable investing.

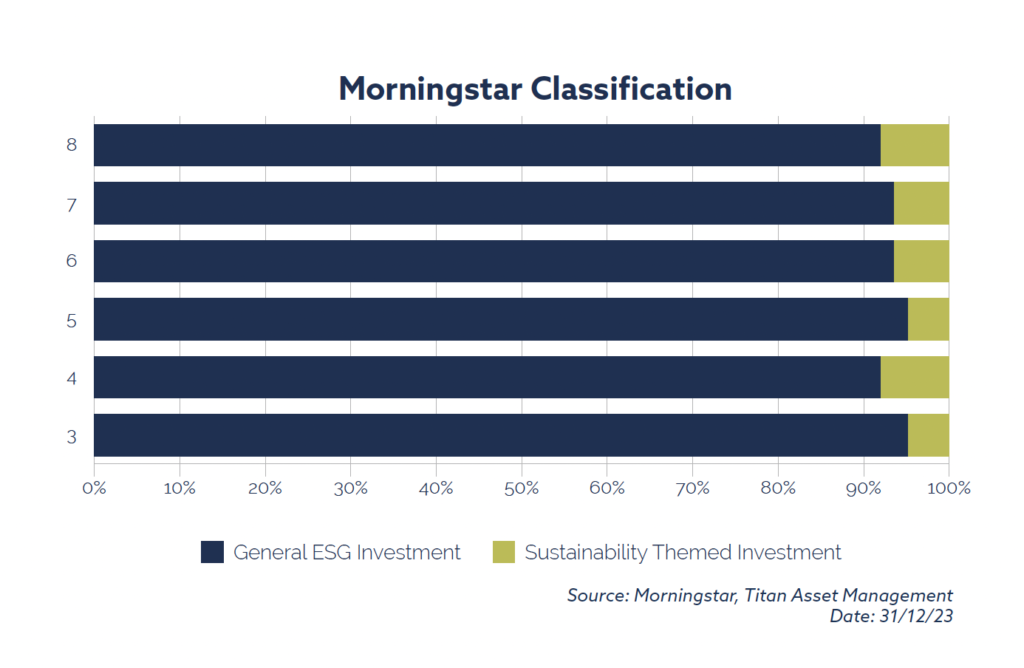

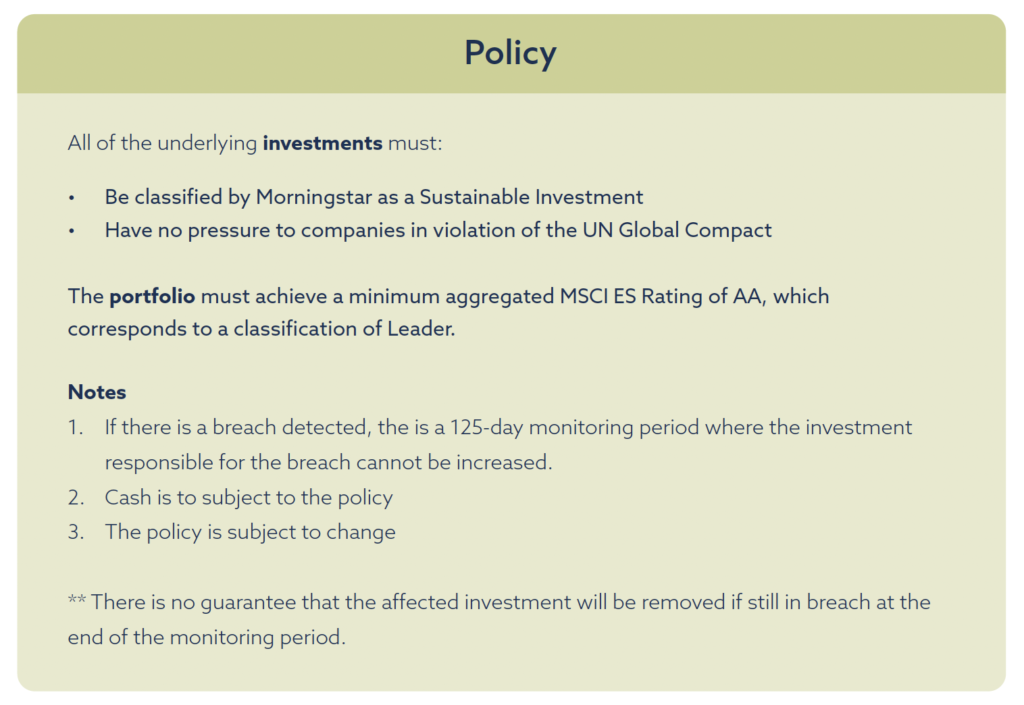

There are three sections to our policy: first, all investments must be classified by Morningstar as a sustainable investment; second, there must be no exposure to investments with any exposure to companies in violation of the UN Global Compact (UNGC); finally, the portfolio of investments must achieve a minimum aggregated MSCI ESG Rating of AA, which corresponds to a classification of Leader (see Appendix for more details).

There are substantial procedures in place to ensure daily compliance with the policy and protocols to follow if a breach to the policy is detected. These procedures and protocols have been put in place to mitigate the industry-wide challenge of greenwashing. The focus on non-financial data-driven risk management is powerful in its simplicity and, importantly, will continue to evolve to match best practice in the sustainable investing ecosystem.

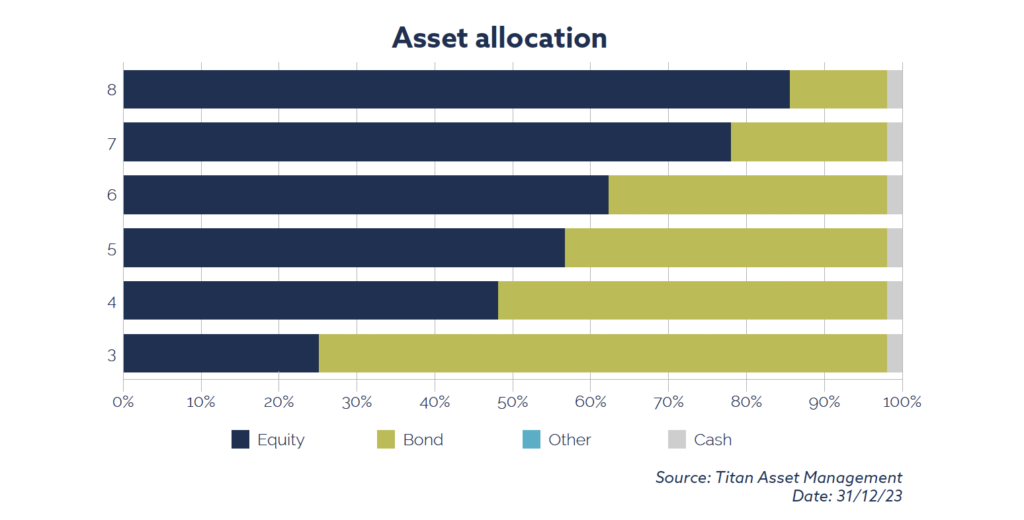

To reflect the fact that we allocate capital across the three sustainable investing pillars, we decided to label our proposition as sustainable. The label accurately reflects the purpose of our investment policy which, as we explained, is designed to separate our investable universe into opportunities that do represent a sustainable allocation of capital and those that do not. There are six risk progressive models (3-8) in the Titan Sustainable MPS.

Q4 REVIEW

The purpose of this section is to review performance over the prior quarter, as well as any changes to our asset allocation or fund selections.

Performance

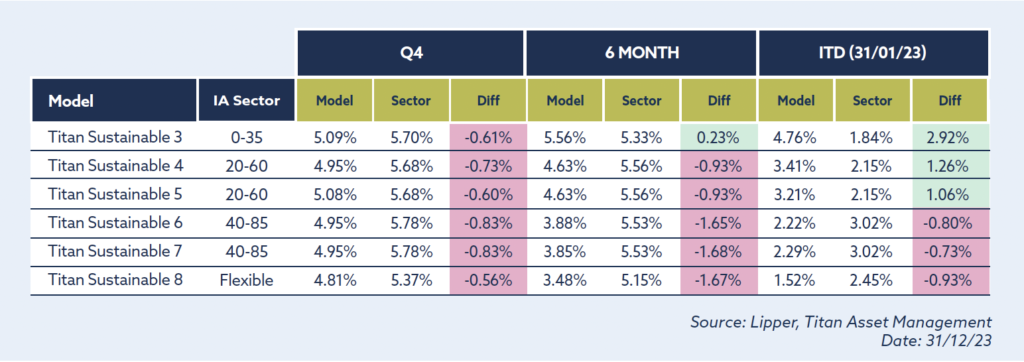

The models performed in line with expectations in Q4. Most asset classes rerated meaningfully, especially fixed income. Our preference for the front end of the yield curve detracted slightly from relative performance, although we benefited from further tightening in credit spreads. Indeed, the BlueBay Global High Yield ESG Bond Fund GBPH performed strongly. Our equity basket participated in the broad market rally, in particular the core of the basket: the CCLA Better World Global Equity Fund, the Storebrand Global ESG Plus Fund and the Vanguard Global Sustainable Equity Fund (which we added towards the end of the quarter).

Model Changes

In October 2023 we made no changes to the Titan Sustainable MPS.

In November 2023 we made a single change to the Titan Sustainable MPS. We removed the EdenTree Green Infrastructure Fund.

In December 2023 we made several changes to the Titan Sustainable MPS. We removed the CT Responsible UK Income Fund, the Dimensional Global Sustainability Short Fixed Income Fund GBPH and the Schroders Global Sustainable Value Equity Fund. We added the HSBC Global Sustainable Government Bond Index Fund GBPH, the L&G Future World ESG UK Index Fund and the Vanguard Global Sustainable Equity Fund.

COMMENTARY

The purpose of this section is to build a narrative around our approach to sustainable investing. Included in this section are monthly commentaries from Q4 2023.

October 2023

October proved difficult for the equity portion of our multi-asset class sustainable investment proposition. This can mostly be explained by the natural bias in our investable universe towards certain style factors and, specifically, to companies providing real-world sustainability solutions. For example, the MSCI Global Alternative Energy Index has fallen almost -30% over the past 3 months, compared to about -5% for the MSCI World Index. There are a few reasons for this derating. First, the COVID-19 pandemic and a general trend towards deglobalisation created supply chain issues, leading to higher input costs for some but also creating issues for others that had stockpiled raw materials only to see demand for their products and services decline. Second, the tightening of monetary policy around the world over the past few years, a consequence of the aforementioned inflation, has materially raised the cost of capital for many companies across our investable universe. Although these cyclical headwinds are cause for concern, the structural drivers of the transition to a more sustainability-minded planet remain in place. From our perspective, valuation multiples are attractive and with COP28 (the 2023 UN Climate Change Conference) around the corner, it is possible that the negative sentiment towards companies providing real-world sustainability solutions will abate soon.

November 2023

More than a year after the publication of the consultation paper and with several delays along the way, on 28/11/23 the FCA finally published the Sustainability Disclosure Requirements (SDR). Like Consumer Duty, SDR has been designed with consumer protection in mind; the purpose of this new set of regulations is to establish a foundation upon which the market for sustainability-labelled investments in the UK can grow in the future. The language used throughout the new policy statement is constructive and it looks like the FCA took on board many of the points raised throughout the consultation period. There are a few key points to note. First, a new anti-greenwashing rule will come into effect on 31/05/24 to ensure that, for authorised firms, all sustainability-related claims are fair, clear and not misleading. Second, a set of product labels was finalised. These are: Sustainability Focus, Sustainability Improvers, Sustainability Impact, Sustainability Mixed Goals. Firms will be able to use these labels from 31/07/24 as long as they concurrently publish associated consumer-facing and pre-contractual disclosures. SDR has been well received by market participants. We think it is a good example of sensible regulation, especially with regard to the implementation timeline. The section in the policy statement about international comparability is especially useful. Most importantly, regulation is now in place and hopefully the financial services industry can leverage this foundation to direct capital towards sustainability-labelled investments in a meaningful way. As the first-ever ‘global stocktake’ at COP28 (the 2023 UN Climate Change Conference) will surely illustrate, there is still a lot of work to do.

December 2023

The most recent gathering of delegates for the United Nations’ annual conference on climate change, COP28, was a complicated affair. Held in the UAE, a fossil fuel giant, and hosted by Dr Sultan Al Jaber, the head of Abu Dhabi’s state-owned oil company, critics pointed to obvious conflict of interests that risked stalling progress towards the decarbonization of the global economy. Indeed, leaked briefing documents showed that Al Jaber intended to use the conference to strike new fossil fuel deals. That said, Al Jaber, who is also the chairman of Abu Dhabi’s state-owned renewable energy company, ended up doing a mostly good job of bringing together all sides of the energy debate, a tricky process which culminated in the ‘UAE Consensus’ to transition away from fossil fuels. This was the first time that fossil fuels were mentioned explicitly in this way at a COP, and signals that the work of future COPs must now focus on the operational challenges (and opportunities) of decarbonisation, not on questions over whether or not to bother. To that end, the final text called for the tripling of renewable energy capacity and the doubling of the rate of energy efficiency improvements by 2030 and included support for a range of cleaner (if not strictly renewable) energy sources like nuclear. Calls to action aside, it is important to keep in mind that the successes or failures of multilateral initiatives like this one are to a large extent determined by the domestic politics of the day. In that sense 2024 is an important year because for the first time countries with more than half the world’s population will vote in national elections.

HIGH LEVEL STATISTICS

The purpose of this section is primarily to measure how well we are managing exposure to material ESG risks and opportunities (see Appendix for more details). Looking at the charts in this section, we can see that we are managing exposure to material ESG risks and opportunities well, scoring better than the market comparison (see Appendix for more details) in each instance.

Morningstar Classification

For all of the funds in their database, Morningstar uses things like regulatory filings to distinguish between funds that represent a sustainable allocation of capital and those that do not. Funds that are classified as sustainable are further broken down into two categories: general ESG investment, for funds that integrate ESG data into the portfolio construction and management process, and sustainability themed investments, for funds that additionally target a sustainability theme like climate action or human development. We can see that all funds held across the proposition are sustainable investments, and most funds are general ESG investments. This makes a good deal of sense, as these funds are far more common than sustainability themed investments.

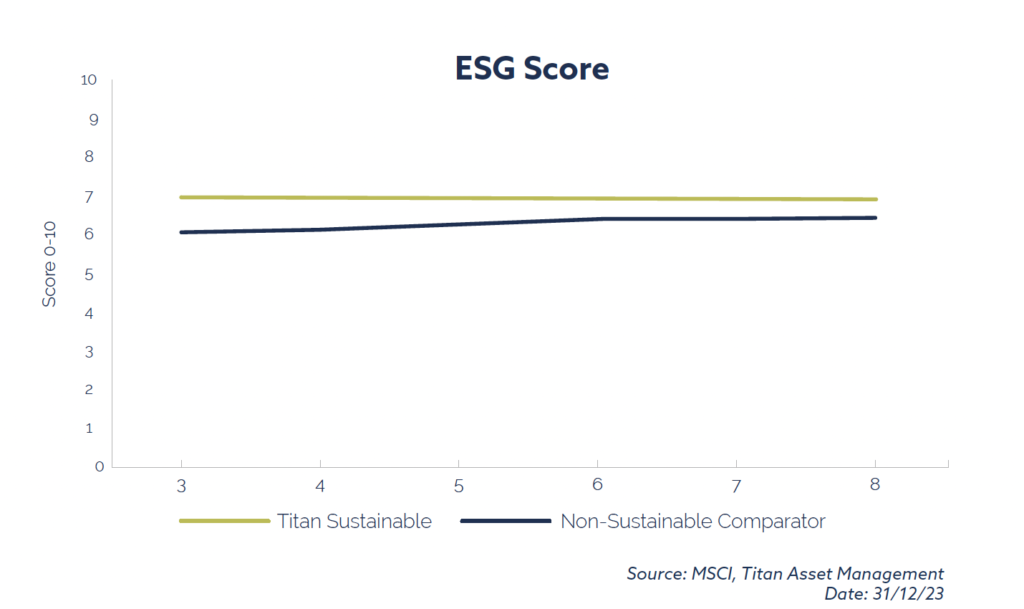

ESG Score

The score is a simple measure of how well key medium- to long-term ESG risks and opportunities are being managed and is measured on a scale of 0 to 10 (worst to best). In each instance, we (green line) achieve a higher score than the market comparison (blue line), indicating that our investments are, on aggregate, managing ESG risks and opportunities better than the market comparison. For the avoidance of doubt, the score should not be used to proxy the impact that a company or country is having on the real world.

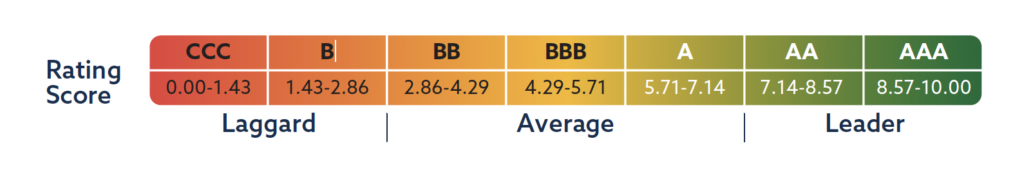

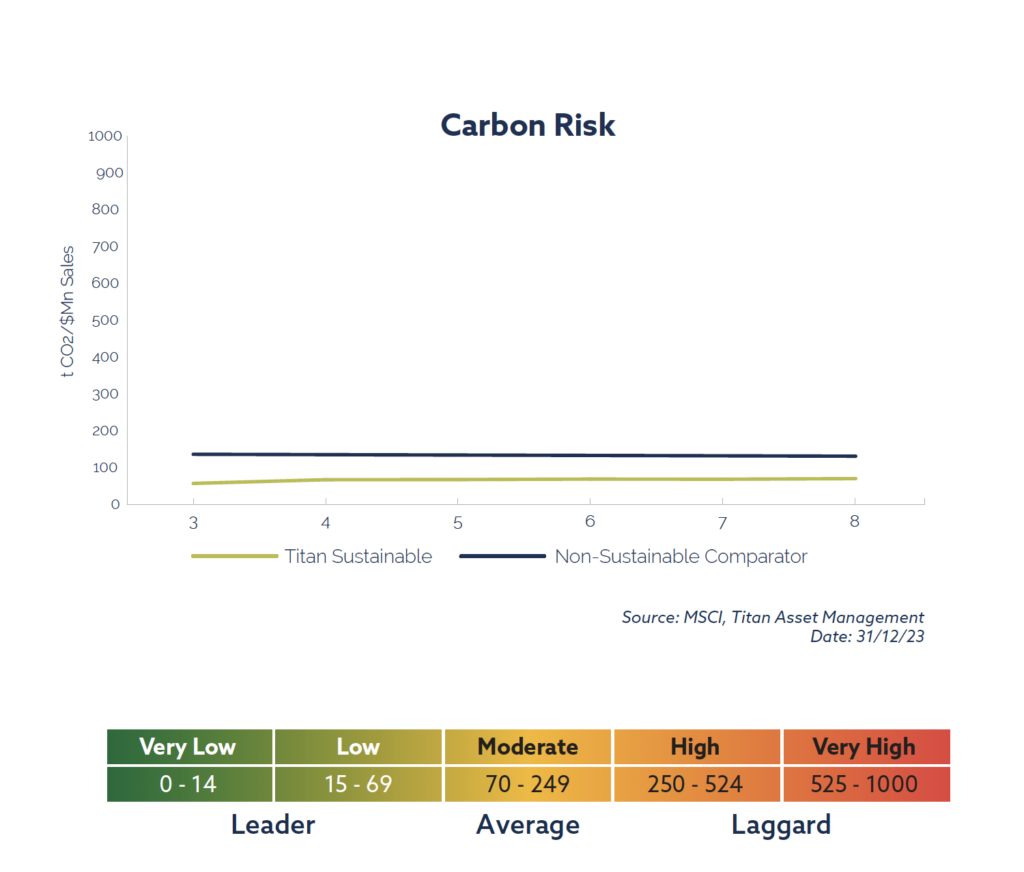

ESG Rating

The rating corresponds to the score (above) and is measured on a scale of CCC to AAA (worst to best). All models achieve an AA rating.

ESG Rating: Distribution

The majority of the underlying holdings across the proposition achieve an A rating or better..

RISK STATISTICS

The purpose of this section is to measure and explore the material ESG risk of the proposition, excluding sovereign exposure. Looking at the charts in this section, we can see that the proposition is far less exposed to material ESG risk than the market comparison.

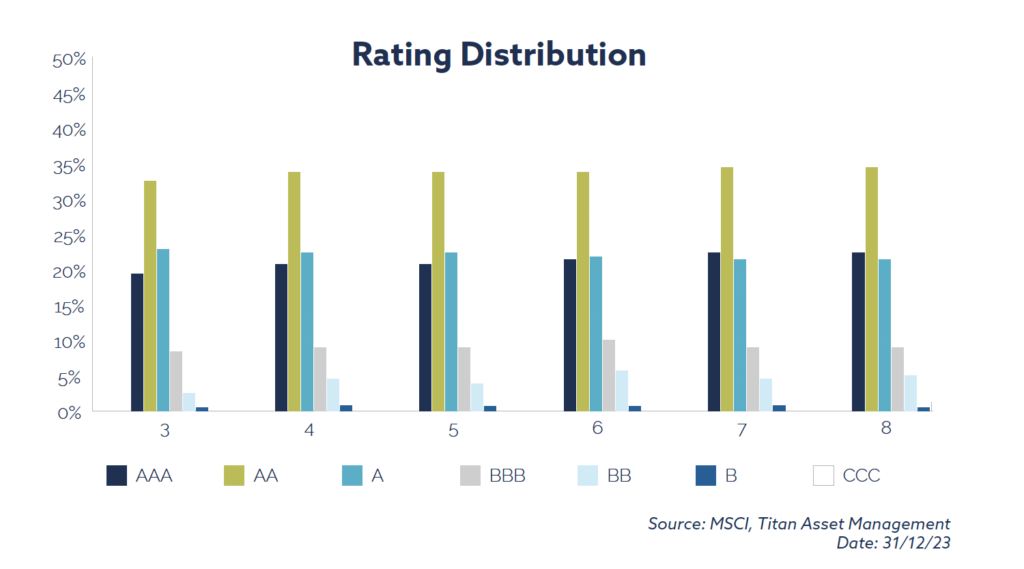

Carbon Risk

Companies which emit lots of carbon dioxide (CO2) are more exposed to carbon-related market and regulatory risks that arise due to climate change. We approximate carbon risk by measuring the carbon intensity of each fund in the proposition, which is the direct plus indirect CO2 emissions of the underlying holdings, divided by sales. Comparing the green line with the blue line, we can see that the carbon risk of the proposition is significantly less than that of the market comparison (the lower the intensity, the better). For Titan Sustainable 6, carbon risk is about 50% lower than the market comparison. According to the US Environmental Protection Agency (EPA), per USD1 million invested this reduction is equivalent to the emissions from about 15 petrol-powered passenger vehicles driven for one year. For the avoidance of doubt, a company with low emissions is not necessarily less exposed to ESG risks and opportunities than its peers.

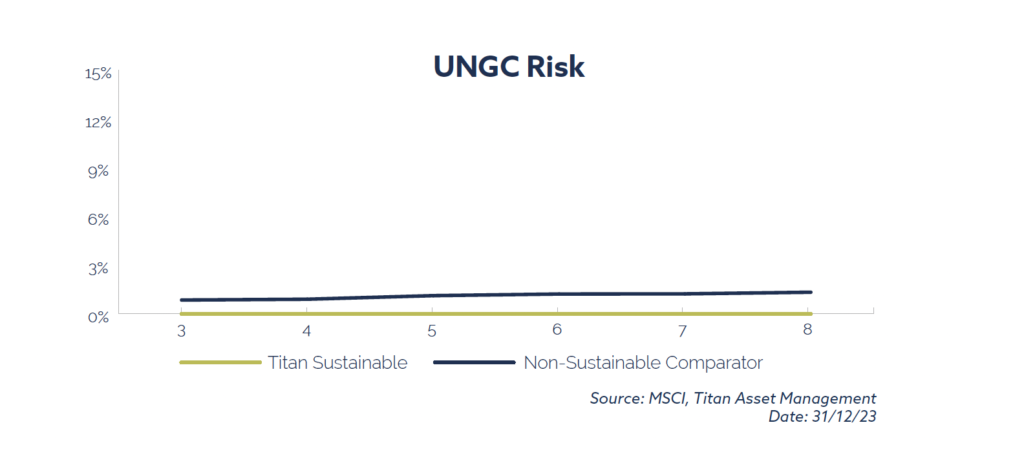

UN Global Compact Risk

There is a spectrum of good and bad actors in every sector and in every country. Measuring exposure to companies in violation of the Ten Principles of the UN Global Compact (see Appendix for more details) is a useful way to separate good actors from bad in a sector- and country-agnostic way (the lower the exposure, the better). The Ten Principles are based on a variety of international declarations and are focused on four areas: human rights, labour, the environment and anti-corruption. The proposition has no exposure to companies in violation of the Ten Principles, unlike the market comparison, which on average has about 1% exposure. For the avoidance of doubt, we rely on MSCI to determine whether a company is in breach of any of the Ten Principles.

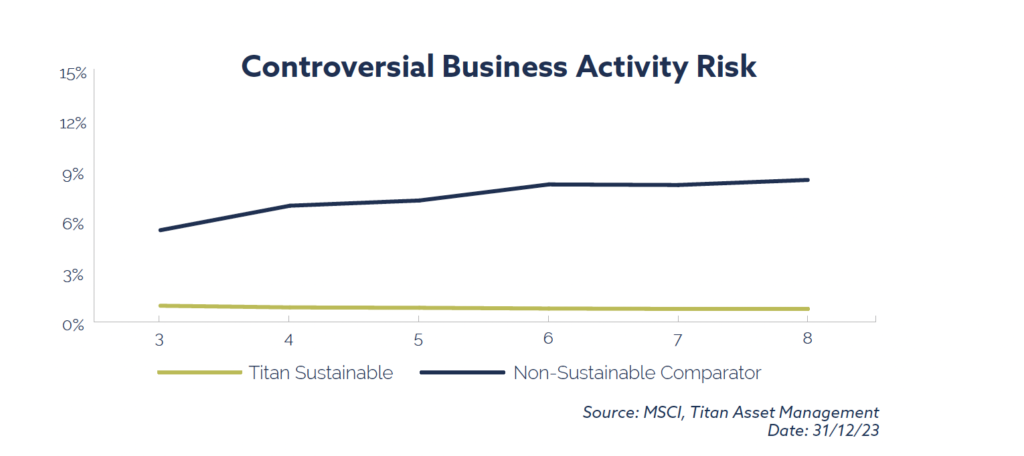

Controversial Business Activity Risk

The aggregated figure represents revenue exposure to a range of controversial business activities: adult entertainment, alcohol, firearms, fossil fuels, gambling, genetic engineering, nuclear, tobacco, and weapons. If we compare the green line, our proposition, to the blue line, the market comparison, we see that the proposition is far less exposed to a range of controversial business activities than the market comparison (the lower the figure, the better).

REAL WORLD OUTCOMES

The purpose of this section is to explore how the investments held across our proposition, excluding sovereign exposure, are affecting things in the real world. As we explained earlier in the report, these outcomes can be measured across a range of sustainability solutions, whether environmental or social in nature. Although our proposition does not follow a dual mandate (risk / return plus impact), we believe it is important to measure and communicate this data.

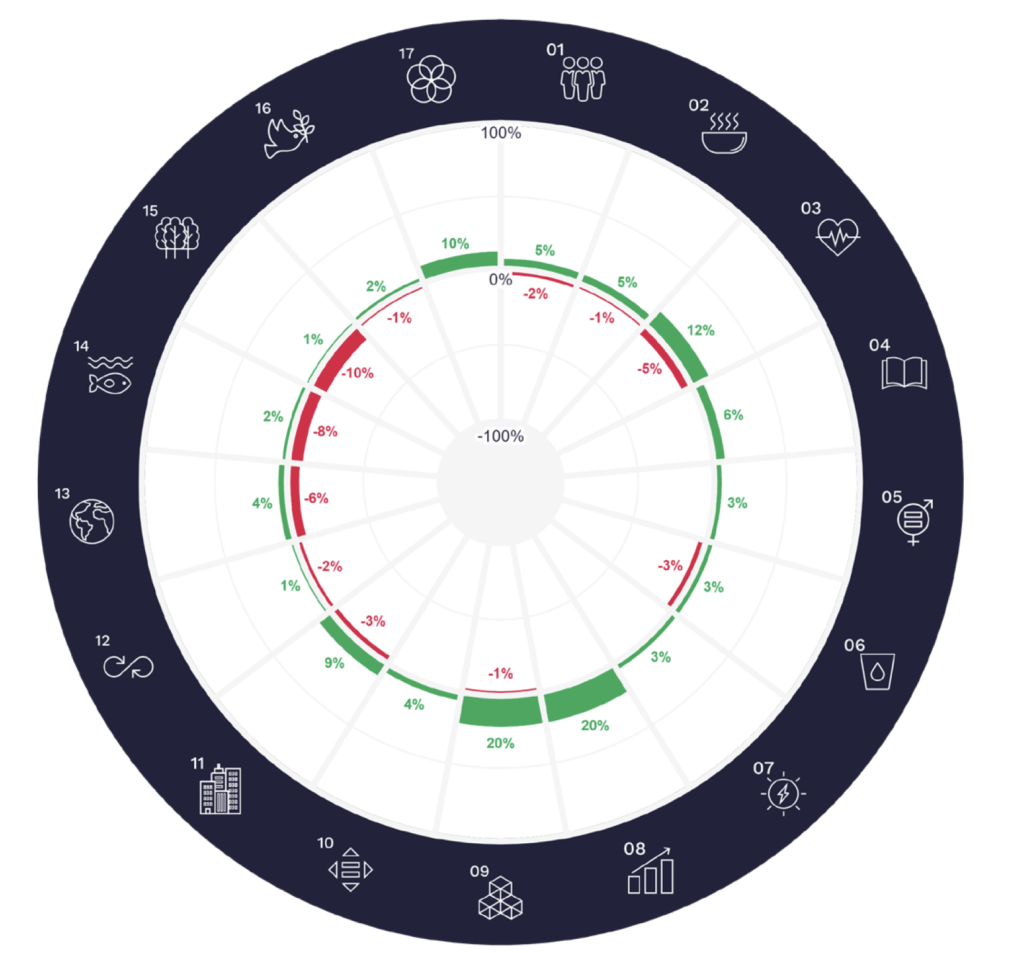

UN Sustainable Development Goal Alignment

The UN Sustainable Development Goals (SDGs) were adopted by the United Nations’ in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. The SDGs are integrated; they recognize that action in one area will affect outcomes in others, and that development must balance economic, environmental and social sustainability. There are 17 SDGs, which can be mapped to 169 targets and a more granular set of 247 indicators.

For more information please visit: Home | Sustainable Development (un.org)

The SDGs provide the common language for investors like us to evaluate these real-world outcomes. Util’s tool relies on natural language processing to disaggregate a company into the constituent products that it sells. These products are than mapped to one or more sustainability concepts drawn from more than 120 million peer-reviewed academic journals. Once the products have been linked to these concepts, and then to the SDGs, the data can be re-aggregated to the company, then the fund, and finally to the level of our proposition. With the data crunching complete, we are then able see, using a radial chart like the one below, how Titan Sustainable 8 is affecting each of the SDGs.

APPENDIX

The investment policy for the proposition is as follows:

The market comparisons used are as follows:

The market comparisons used throughout this report reflect the asset class allocation of each fund based on the underlying investment exposure of the asset portfolio to fixed income (investment grade and sub-investment grade securities) and equity (developed and emerging market) securities at the date of data. This information is for illustrative purposes only to provide an indicative comparison between a fund and a non-ESG market equivalent.

The full names for all MSCI ESG metrics used are as follows:

- ESG Score = MSCI ESG Quality Score

- ESG Rating = MSCI ESG Rating

- ESG Rating: Distribution = MSCI ESG Rating Distribution

- Carbon Risk = MSCI ESG Carbon Risk

- Controversial Business Activity Risk = MSCI ESG Business Involvement Screening Research Involvement

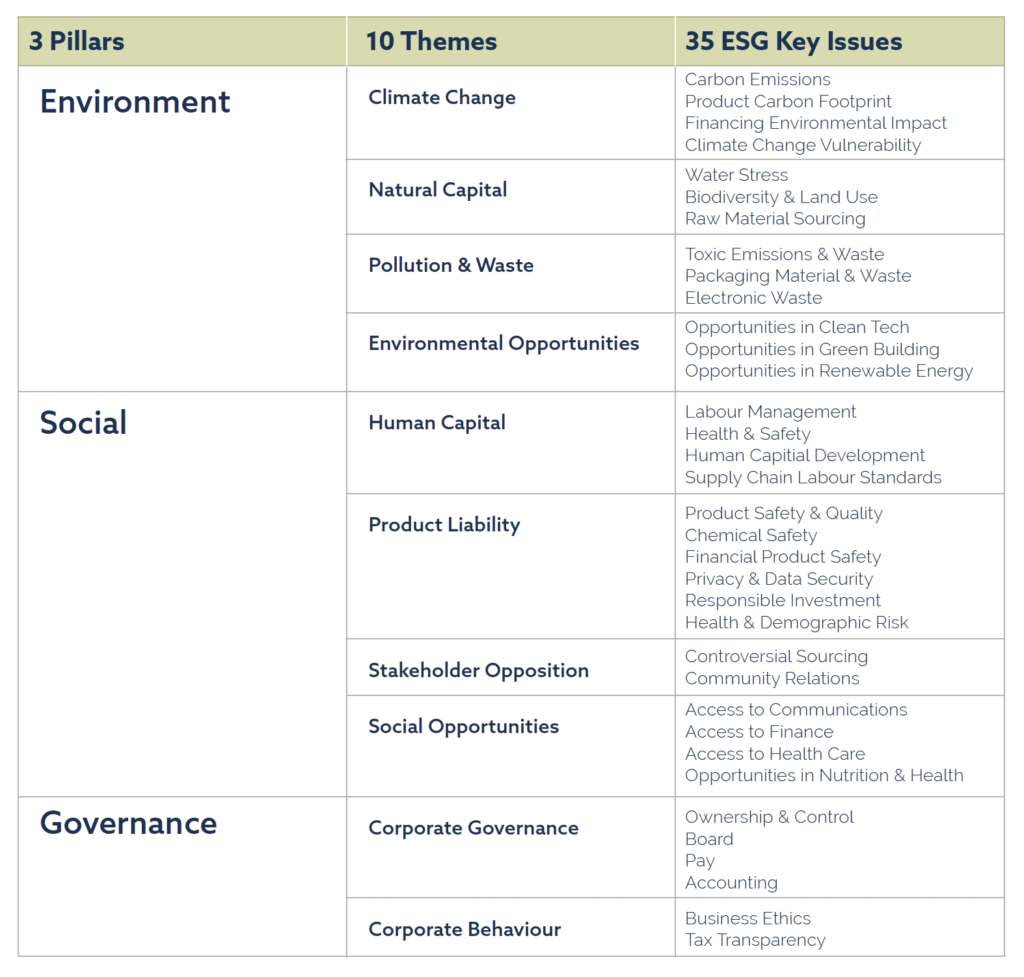

The MSCI ESG Key Issue Hierarchy is as follows:

The Ten Principles of the UN Global Compact are:

For more information please visit https://unglobalcompact.org/what-is-gc/mission/principles

UN Principles for Responsible Investment (PRI)

Investor Initiative

Titan Asset Management became a signatory to the UN Principles for Responsible Investment (PRI) in 2022. The PRI is the world’s leading proponent of responsible investment. It works to understand the investment implications of ESG factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions. The PRI acts in the long-term interests of its signatories, of the financial markets and economies in which they operate, and ultimately of the environment and society.

To find out more about the PRI and the principles, please visit www.unpri.org

CCLA Global Investor Statement on Workplace Mental Health

Investor Initiative

Titan Asset Management joined this investor coalition in 2023. CCLA, the UK’s largest charity asset manager, have done excellent work to shine a light on the importance of workplace mental health, the improvement of which is of benefit to both employees and their employers. We believe that collaborative engagement, where a group of investors pool resources to initiate dialogue with a company or government on a specific set of issues, is one of the best ways in which we can lend our brand and assets under management to initiatives like this one tackling important issues.

To find out more about CCLA, please visit www.ccla.co.uk

19 Global Returns Project (GRP)

Charity Partner

Capital allocation will play a meaningful role in the transition to a more sustainability-minded planet. Measuring the impact of our capital allocation, as we do by using Util’s dataset, is an important first step for us in this transition. But, as the radial chart in the Impact Statistics section indicates, we can go further. Titan Asset Management became a partner of the GRP in 2022. GRP is a UK registered charity (no. 1186683) which curates the ‘Global Returns Portfolio’: a selection of diverse and effective not-for-profits tackling the twin biodiversity and climate crises. We have integrated a donation to GRP into our fee structure for some bits of our proposition. The purpose of doing so is to resolve the disconnect between allocated capital and real-world impact.

To find out more about the PRI and the principles, please visit www.globalreturnsproject.earth

ESG Accord Initiative

Sponsorship

The sustainable investment ecosystem has evolved rapidly in a short space of time, both in terms of innovation and regulation, and the volume and pace at which this has happened mean new developments can be difficult to keep track of. The purpose of ESG Accord Initiative is to deliver best practice compliance, education and advice solutions to support financial advisers, their clients and other market participants. Titan Wealth Holdings Ltd (the parent company of Titan Asset Management) is delighted to be a founding sponsor of the Initiative, and we look forward to contributing to this resource in order to improve client outcomes for all.

To find out more about the Initiative, click www.esgaccord.co.uk

London School of Economics Green Finance Society (LSE GFS)

Sponsorship

Titan Wealth Holdings Ltd (the parent company of Titan Asset Management) became a sponsor of the London School of Economics (LSE) Green Finance Society (GFS) in 2020. The GFS is the sole sustainable finance-focused society at LSE. Their mission is to encourage greater consideration of ESG risks in financial decision-making and to equip LSE students with the skills and background knowledge required in this field. Over the past few years, we have enjoyed working with the GFS on a series of events, as well as participating in their flagship annual conference. We continue to be impressed by the students’ enthusiasm for and understanding of topics within sustainable finance.

To find out more about the GFS, please visit www.lsesugreenfinance.com

8 DISCLAIMER

Titan Asset Management is authorised and regulated by the FCA. The company is registered in England and Wales with Company Number 7805960. This report together with any other attachments are confidential and may only be read, copied and used by the intended recipient. You should not disseminate, distribute or copy this presentation. Titan Asset Management has approved this as a marketing communication and it is for private circulation only, and in the UK it is directed to persons who are professional clients or eligible counterparties for the purposes of the FCA rules and it must not be distributed to retail clients. It does not constitute an offer to sell or invitation to buy or invest in any funds mentioned herein and it does not constitute a personal recommendation or advice on investment, taxation or anything else. The information and any opinions are based on sources believed to be reliable, but accuracy cannot be guaranteed. Registered address: Titan Asset Management, 101 Wigmore Street, London, W1U 1QU.

Although Titan Asset Management’s information providers, including without limitation, MSCI ESG Research LLC and its affiliates (the “ESG Parties”), obtain information (the “Information”) from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warrantees, including those of merchantability and fitness for a particular purpose. The Information may only be used for your internal use, may not be reproduced or disseminated in any form any may not be used as a basis for, or a component of, any financial instruments or products or indices. Further, none of the Information can in and of itself be used to determine which securities to buy or sell or when to buy or sell them. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.