During a volatile year for investors, sources of alpha, specifically uncorrelated alpha, have been hard to find and harder still to maintain. The majority of major indices have fallen in value this year, with global equities down down -6.29%, the Nasdaq down -19.39% and Bloomberg Barclays Global Aggregate down -11.08%. In previous bouts of weakness in bonds and equities, investors have tended to turn to alternative exposure for uncorrelated returns. However, many have exhibited double digit negative returns.

For example, the iShares UK property ETF is down -31.21% and its American counterpart down -15.15%. This has been spurred on by demand side weakness as rate hiking cycles have increased the marginal cost of debt finance and mortgages above tolerable levels. This, coupled with higher input costs for homebuilders and servicing agents has led to weakness in the sector.

In these above conditions, commodity and commodity proxy exposure may not have seemed the inherent trade to make. A relentless US dollar, interest rate hiking cycles, and recessionary worries have impacted various commodity sub-sectors sensitive to these inputs.

However price support has come from ongoing geopolitical risk exacerbating existing supply-side inefficiencies, a hangover from acute underinvestment during the pandemic. Persistently high inflation readings have provided further support. This has led to a large dispersion of returns within commodities, requiring discretion and conviction when determining asset allocation. When we look at the performance of our positioning within this asset class, consistent sources of alpha emerge that have added to portfolio level performance this year.

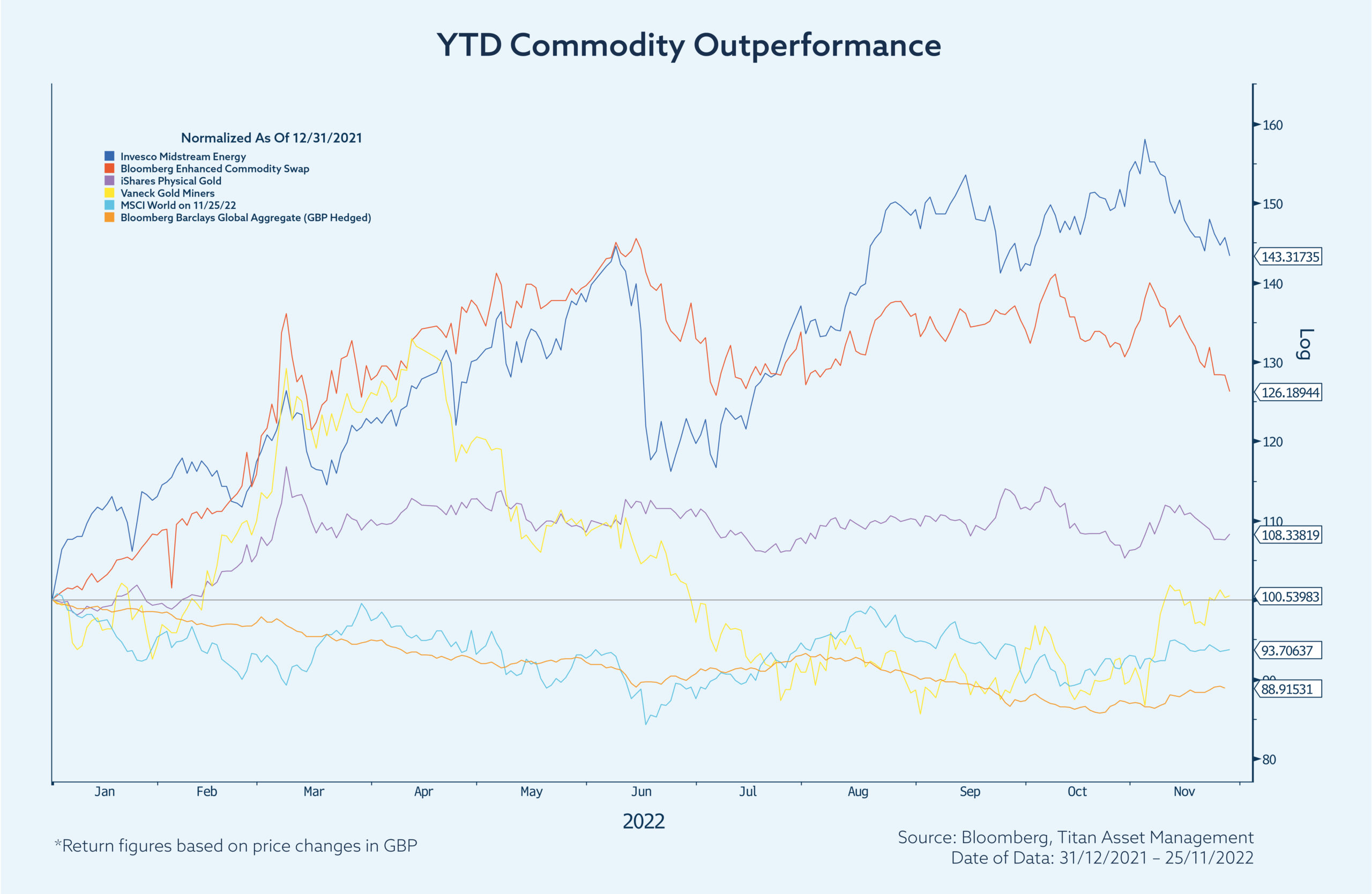

As shown in the chart, all four of our main commodity or commodity proxy positions have outperformed the shown equity and bond benchmarks. Our position in US midstream energy companies has returned 43.32%, the enhanced commodity swap is up 26.19%, physical gold 8.34% and the higher-beta equity proxy of gold miners up a modest 0.54%. In comparison to benchmark returns, this represents consistent outperformance, with our exposure to midstream US energy companies outperforming the global equities by 49.62% so far this year.

Indeed, we believe that the environment for continued outperformance for certain commodities is in place. This is specifically pertinent to our precious metals allocation. Whilst gold has outperformed certain equity and bond indices, we do not believe the yellow metal has realised its full potential this cycle. A strong dollar and rising global interest rates have capped price appreciation, and flows into alternative supposed safe-havens such as crypto-currency have, until recently, proven more attractive.

As discussed in our Q4 Quarterly Perspectives, we retain a cautious view on equities and see further relative upside to precious metals. With peak inflation, the growing recessionary narrative and softening rhetoric from Jerome Powell and the US Federal reserve, we think gold has room to run over the course of 2023.

As views on peak US interest rates have softened, we have seen a bottoming of the 10-year Bloomberg Inflation Swap real rate index, which moves inversely to future interest rate expectations. Given the historic correlation to gold, a continuation of this narrative should pave the way for further gold appreciation next year.

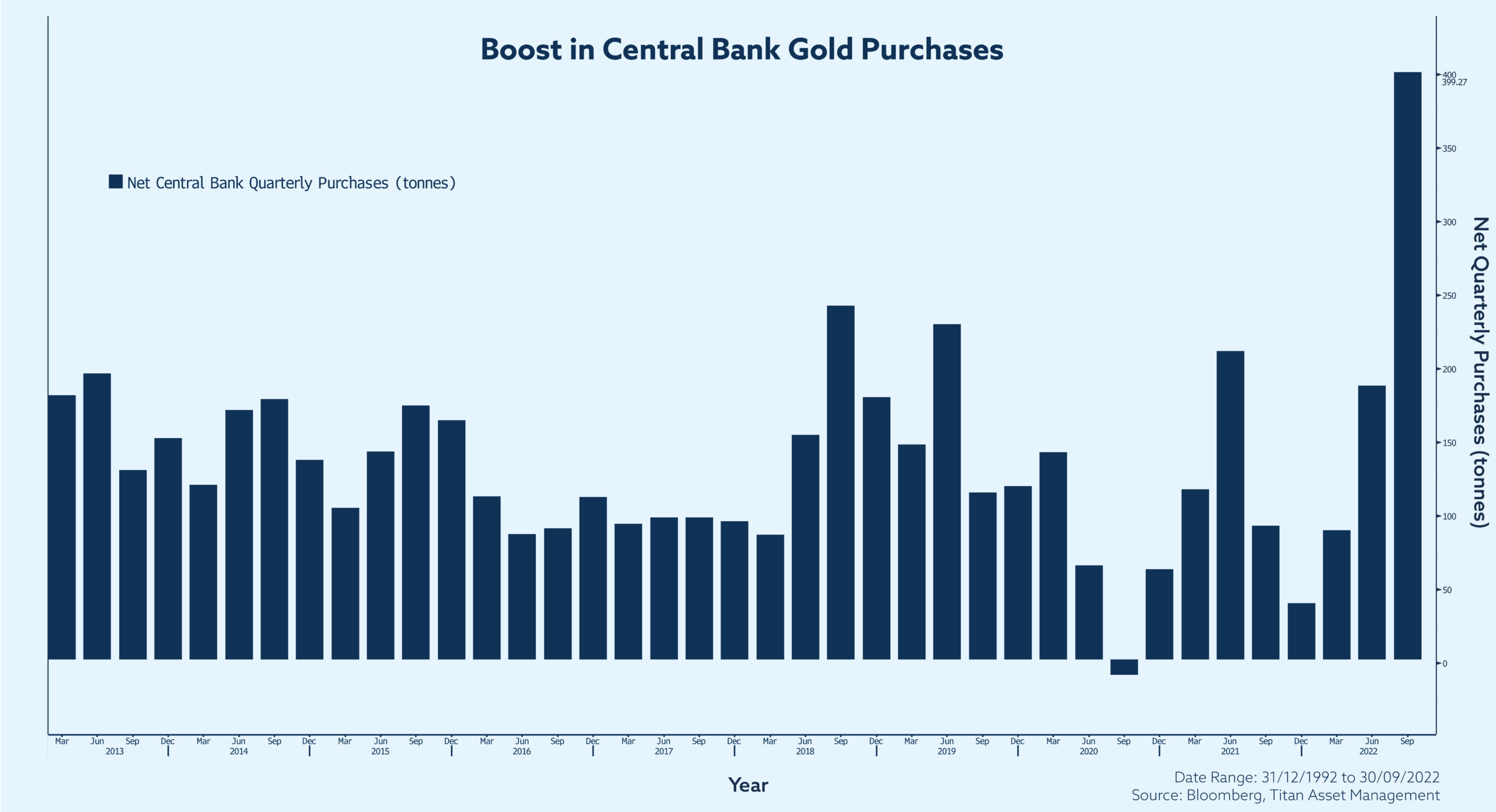

Compounding this, behind 1967, this is the second largest year for central bank gold buying. With this increased engagement from institutions, ongoing geopolitical turmoil and the rhetoric surrounding hiking cycles, we believe gold continues to play an important role in prudent risk management, and currently there is a strong fundamental case for holding gold in a balanced portfolio.

Jonah Levy