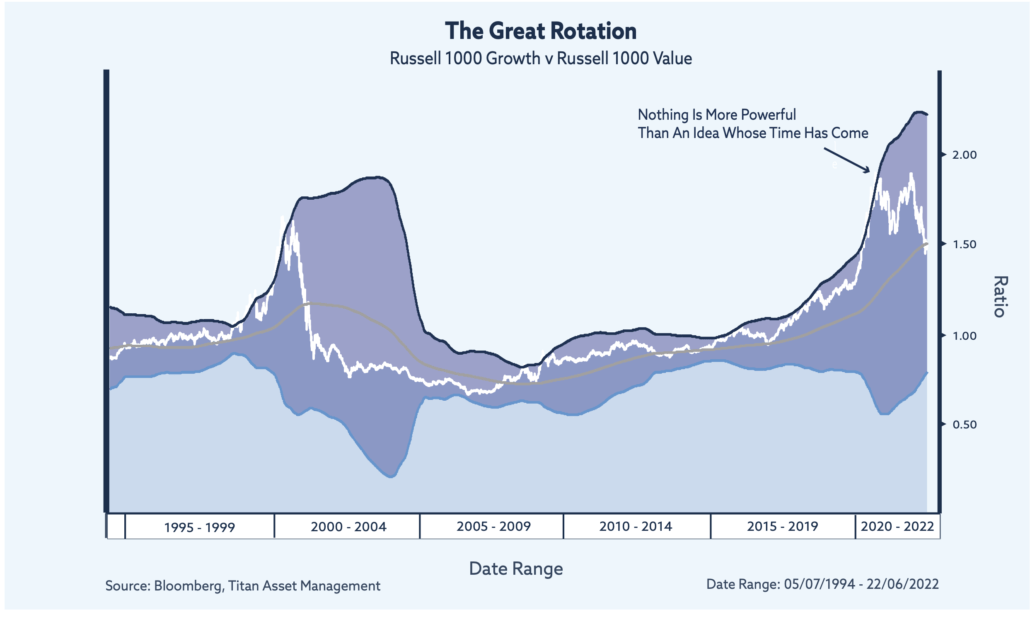

Back in November 2020 I wrote a blog, Nothing Is More Powerful Than An Idea Whose Time Has Come, in which I made the case for a Great Rotation across equity markets where the prior winners, growth stocks, would give way to value stocks which would outperform going forward. I used the following chart (updated to the present day), which was accompanied by the following commentary:

During the depths of the crisis, investors had been willing to pay anything for growth, valuations be damned. But the parabolic performance of growth stocks over value could not be sustained forever. This is demonstrated in the chart by prior such occasions where the growth-to-value ratio has breached the 3 standard deviation Bollinger Band, which we use to denote a move of extreme proportions. Prior occasions have resulted in a clear reversion to the mean, in this case the 4-year moving average, in grey.

As you can see – that call proved timely. The growth/value ratio has since fallen to its long-term mean with much of the move materializing over the last few months. That said, it’s been a bumpy journey, as demonstrated in the chart below which zooms in on the last few years and gives you a sense of the volatility experienced along the way.

When we first positioned the ACUMEN Portfolios for the Great Rotation, we rotated into US value stocks and sector specific plays in industrials, materials and financials. That worked incredibly well as a sense of optimism crept back into markets, predicated on strong economic data, the Biden blue wave and a surge in bond yields which turbo charged the trade.

As a result and given our currency overlay strategy at the time with GBP/USD at 1.42, by the end of May 2021 ACUMEN Portfolio 7 was ranked number 1 out of 175 funds within its IA sector peer group benchmark. However, over the following months we saw the rise of the Delta and Omicron variant and a savage rotation back into growth. By the end of 2021, the growth/value ratio had risen back towards its prior 2020 high.

The volte-face led to a short period of underperformance during the summer months. We knew we had the right medium-term strategy in place but were surprised by the severity of the whiplash back. In keeping with our technical approach to risk management, we pivoted the portfolio in August, to neutralize risk (shortly after the break of the yellow line in July 2021). This worked well as a precautionary measure and the funds largely outperformed their respective benchmarks across Q4. The first two weeks of 2022 witnessed a savage and violent bout of risk aversion, which I commented-on at the time in Bumpy Start:

For the last two-ish years, markets have enjoyed a buy-the-dip mentality as pro-growth fiscal and ultra-accommodative monetary policies have kept the show on the road. However, with the new year came a renewed sense that this narrative may be coming to an end. Central banks are turning increasingly hawkish, in response to high and persistent inflation, and prior fiscal tailwinds (2021 was the biggest expansion of fiscal policy in history) are now turning to headwinds. As a result, investors have started taking profits.

With equity and bond prices at elevated levels, stubborn inflation, monetary policy tightening, supply chain bottlenecks and a general decline in pent-up demand in the post Covid-19 era, we repositioned the ACUMEN Portfolios to account for these growing risks.

The chart below is my preferred way of communicating just how stretched valuations had become. It shows the historic relationship between the total value of the global stock market versus global GDP. These two metrics cannot move too far out of line without reverting to the mean. Given prior such occasions, circled in yellow, have resulted in subsequent and notable bouts of risk aversion… with the current disconnect at extreme proportions, there is potentially a long way down.

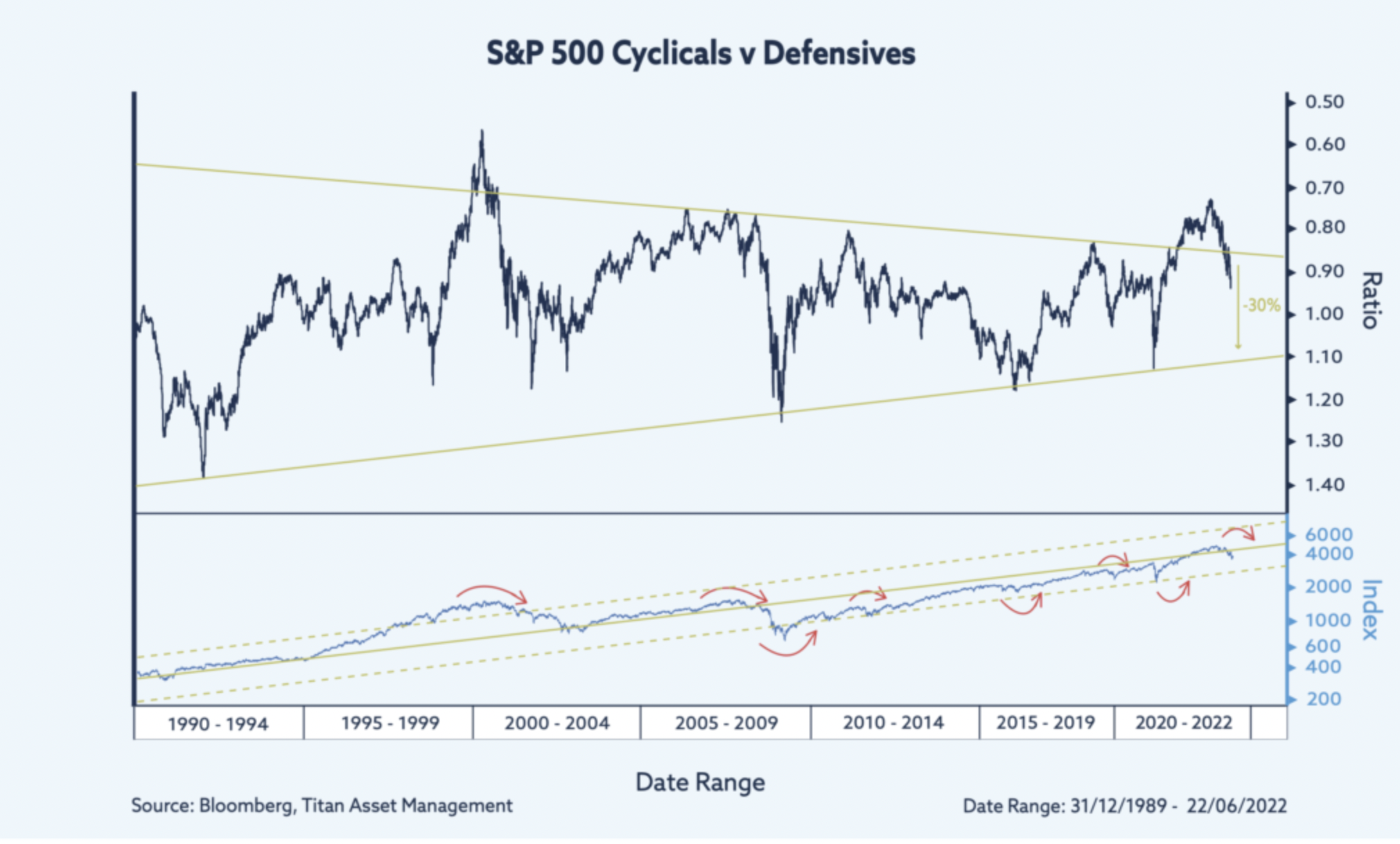

From a technical perspective US equity valuations looked particularly stretched, with cyclical stocks set to underperform defensives by around 30%. At an index level this is consistent with the S&P 500 falling to the bottom of its long-term uptrend at around 3,000.

Within our US equity bucket, we rotated into defensives and currently retain positions in minimum volatility stocks and healthcare, which have outperformed the broader market. The new year saw a return to the value trade, something I also wrote about in the January blog, Bumpy Start:

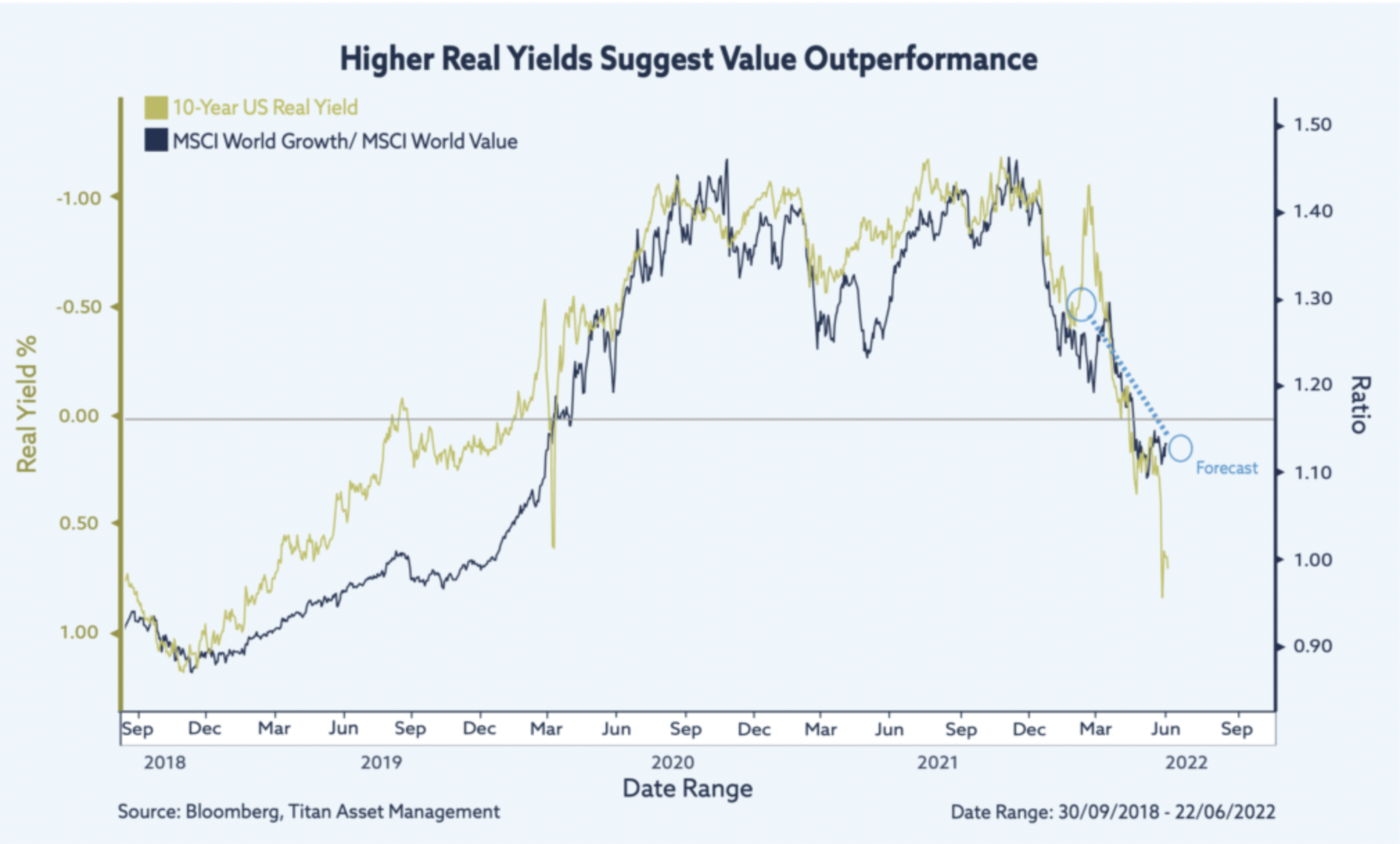

Forecasting anything on a short-term basis can be tricky, but we do think the direction of travel [in US real yields] is up. Real yields are a key driver for a whole host of different markets… If the forecast holds true, we should see value stocks outperform growth this year.

It’s not too common for predictions to come true, but when they do, and we get it right, it’s worth mentioning.

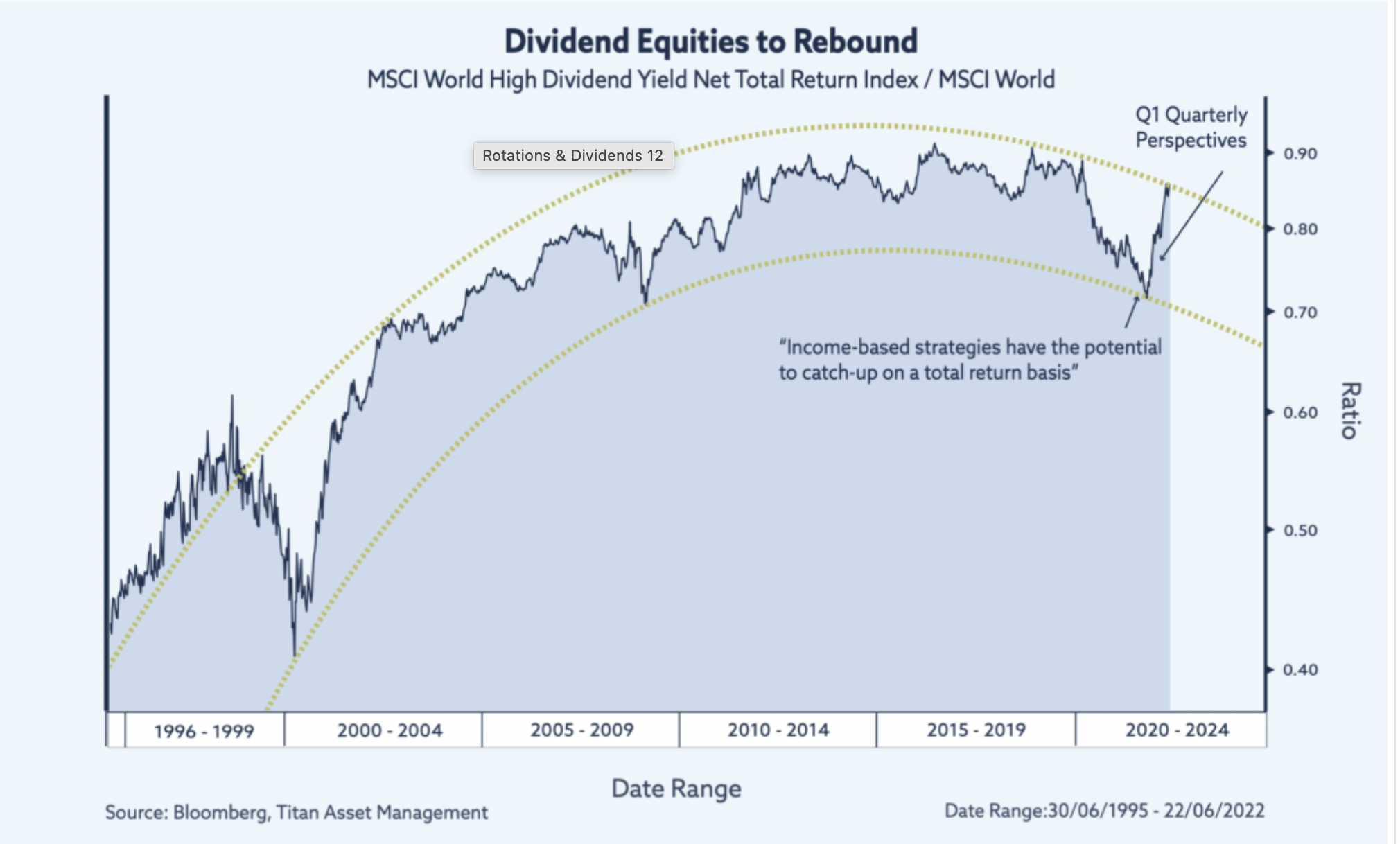

However, given elevated volatility, and mindful of the lessons of the past, we opted to play this theme via dividend paying equities, which we wrote about in Investment Week magazine in November 2021 and reiterated in the final thoughts section of the Q1 2022 Quarterly Perspectives:

The rationale for this trade is simple. As equities look set to outperform fixed income in the inflationary environment laid out ahead, asset allocators are incentivised to look to dividends and high dividend stocks as a source of income over the coupons generated from bonds. Furthermore, from a historical perspective, dividend paying strategies have tended to outperform late cycle and if inflation does persist, then the best place to be is in those companies positioned to benefit from rising rates that have pricing power and can deliver dividends.

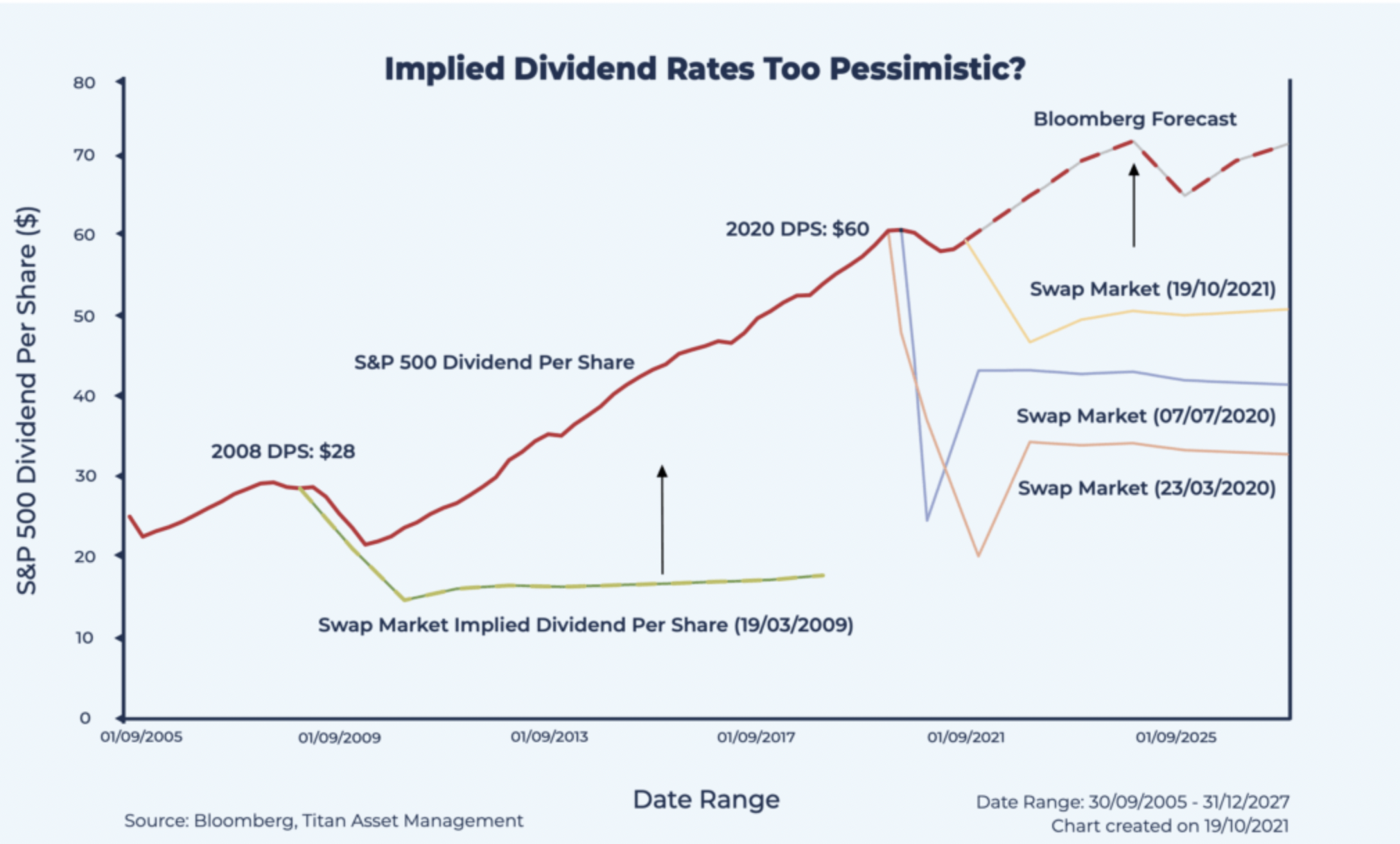

These companies tend to overlap with the value and quality factors which, as stable businesses, typically demonstrate lower volatility. At the time we also felt the market remained too pessimistic on dividend strategies which presented a compelling opportunity, as demonstrated in the commentary and chart below:

There is a phrase that history does not repeat itself, but it does rhyme. The chart is quite interesting as it shows how pessimistic US equity markets became in the immediate aftermath of the 2008 Global Financial Crisis versus what actually happened to dividend strategies. Specifically, it shows the dividend per share for the S&P 500 versus the implied dividend derived from swap-based market data at that time. I think we are seeing something very similar playing out right now and I believe markets remain overly pessimistic, which presents a compelling longer-term investment opportunity.

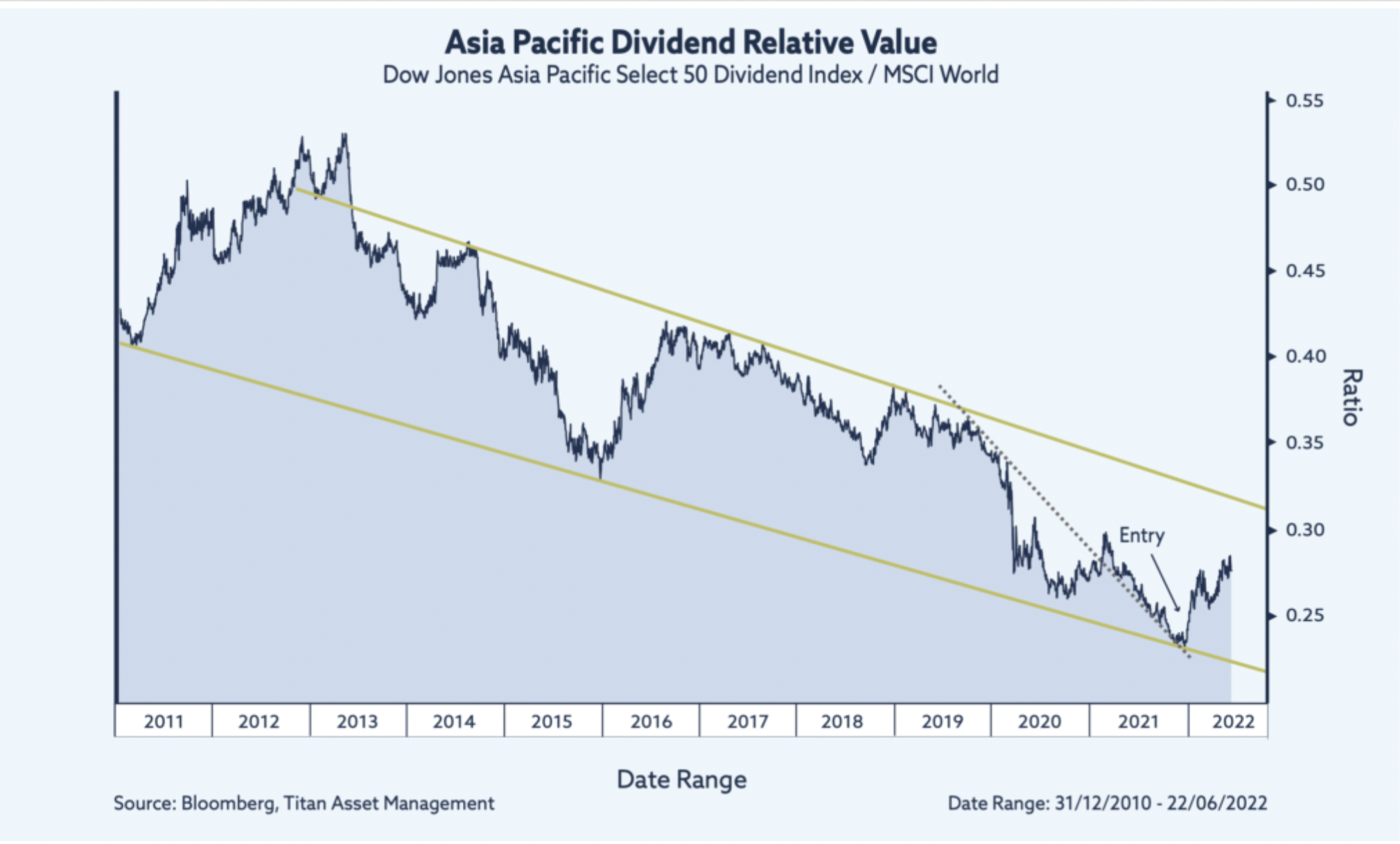

As such we rotated approximately 70% of the equity allocation across the ACUMEN Portfolios into dividend paying equities. We initiated several new positions in the UK, Europe, Asia Pacific and globally. Since inception these trades have delivered strong outperformance versus the broader market.

Our global dividend aristocrats’ position, which refers to companies which deliver consistent dividend growth over time has recovered strongly from the lows and is now looking to re-enter the prior downtrend relative to the MSCI World.

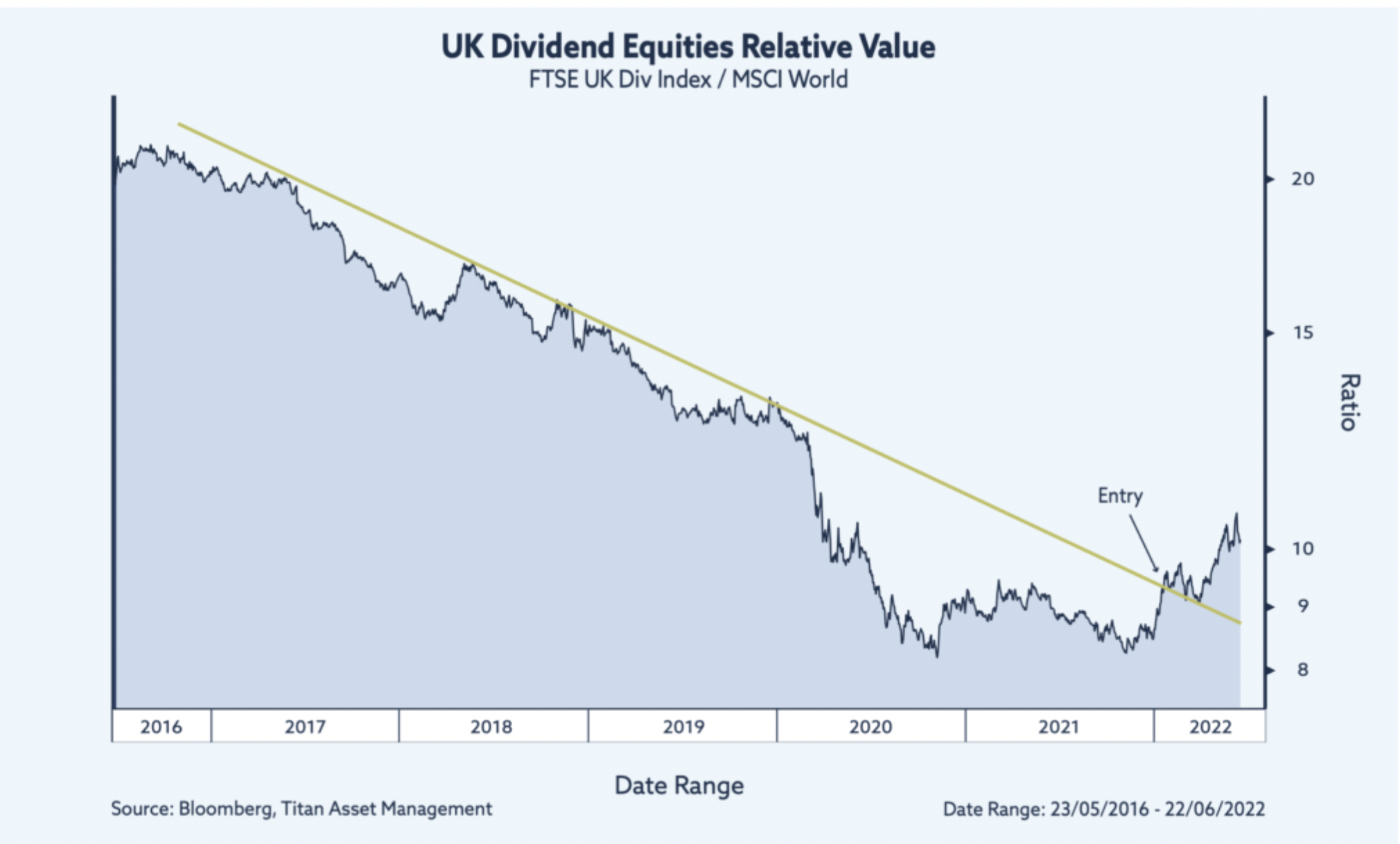

UK equities have underperformed the broader market for some time. Given compelling valuations and an attractive outlook, we opened positions in the FTSE 100 and a basket of dividend paying UK equities, which has broken out of its multi-year downtrend.

Our allocation to dividend paying European value stocks has had a slightly bumpier ride, underperforming sharply following Russia’s invasion of Ukraine. However, since then the position has found support and has also broken out to the upside.

For now, we retain conviction in the dividend theme. However, we are mindful of several growing risks to our outlook. Firstly, valuations are less compelling today than they were several months ago. Second, there is a growing risk that the recession narrative picks-up pace.

This could impact corporate earnings and the ability of firms to pass on dividends to investors. Should this coincide with peak inflation, commodity prices and a further shift in risk sentiment, as investors take their cue to shift from equities to the relative safety of bonds, then we could see an erosion of many of the tenants underlying this strategy.

For now, it is too early to make that call. Our goal is to adapt to markets as they evolve and as always, exercise strong risk management throughout.

FOMO in the death zone

This weekend I watched Top Gun 2. Good movie, nothing on the original, but a great soundtrack, specifically the Kenny Loggins song: […]