Global markets in 2022 have exhibited abnormal volatility. Inflation readings sit at multiples of central bank targets around the world, and a plethora of rate hiking cycles have begun in attempts to combat this. Muted capital expenditure during the pandemic has left supply chains in tatters, and producers scrambling to secure inputs. When compounded by an invasion involving two hegemonic commodity producers and a pilgrimage towards net-zero carbon emissions, we at Titan believed an environment for sustained commodity outperformance was firmly in place.

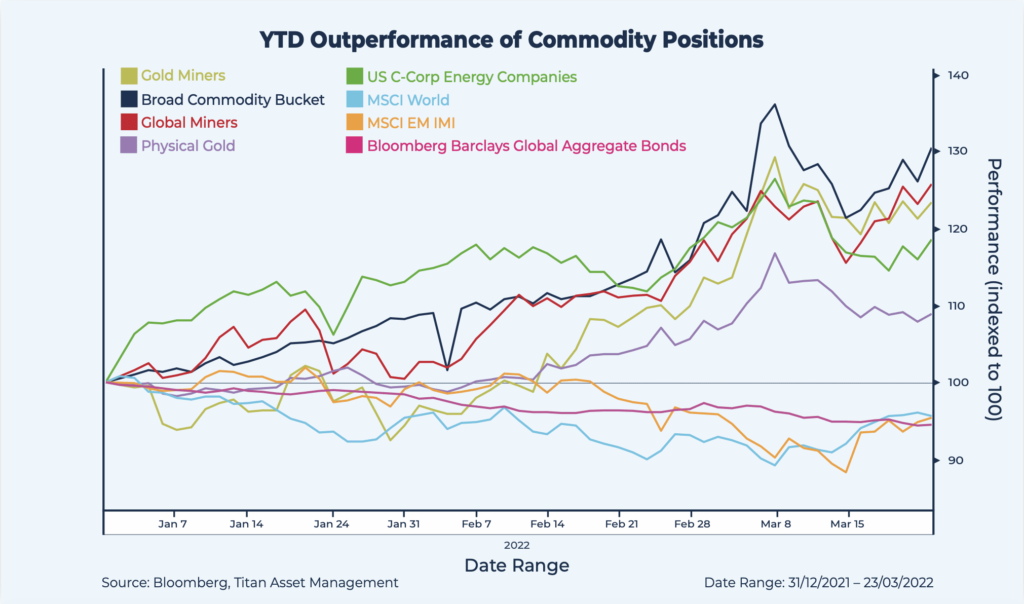

Indeed, the purpose of this blog is to highlight the strong outperformance year to date of our commodity carve-out as well as our commodity linked equities within the Acumen Portfolios and wider CIP. We wrote of a bullish setup for commodities in our quarterly perspectives in 2020.

This was before the notion of a commodity super-cycle was being bandied about by some major investment houses, and we saw saw real opportunities for outperformance vs other asset classes. Thus, we have been overweight commodities since that point, crystalising strong profit in copper, silver, and most recently in commodity heavy Russian equities at the start of this year.

More recently, we have rotated into gold mining equities and global mining equities, whilst maintaining our exposure to physical gold and a broad-based commodity basket with an enhanced roll yield caveat. We have also enacted our bullish energy views through C-Corp US midstream energy companies, a position which has delivered exceptional yields and capital appreciation.

YTD price return in GBP can be seen below:

Looking forward, we see potential for further outperformance in specific commodities, especially when benchmarked against equities. Whilst valuations have risen across this space, we believe recent events have shed light on what is a structural imbalance in commodity markets. For a clean energy transition, we will need multiples of current demand for a new sub-sector of sustainable commodities.

Historically, commodities tend to perform well in the early stages of a rate hiking cycle; having returned an annualized 17.3% during the last 8 hiking cycles over 50 years. As this plays out across markets, defensiveness through precious metals, cyclical value exposure through the miners, and bets on decarbonisation should aid the portfolios in continued outperformance.

John Leiper, CIO on CNBC 23rd February with Stephen Sedgwick and Karen Tso

Today, 23rd February, Titan Asset Management CIO, John Leiper, CFA, FDP, CFTe appeared on CNBC this morning with Stephen Sedgwick and Karen Tso. Leiper discussed the AI frenzy, and what […]