Key Themes

In a few short years we have seen a global pandemic, economic crises, historically high inflation, burdensome interest rates and wars around the planet, including in Ukraine and Gaza. 2023 was a year for the history books and we doubt 2024 will be any less eventful. Elections this year will determine the leadership of over 40% of the world’s population, or 60% on a GDP weighted basis. Within that sweeping number, the range of countries is broad. The list includes the UK, where Labour is ahead in the polls, to many European countries including Austria and Belgium, following a decisive shift toward populist candidates in 2023, as happened in Italy, the Netherlands and Slovakia. This is also a theme in the US, which could see the return of Donald Trump who successfully survived two impeachment proceedings last year. Elections will also be held in Russia, where Putin will run unchallenged and Taiwan, whose sovereignty remains under ongoing threat from China. The range of outcomes are broad and too difficult to predict other than to say that with change comes] risk but also potential opportunities. The same can be said for the global economic backdrop. We are yet to see the full impact prior monetary tightening which will feed through to the real economy this year given the inherent lags from prior policy decisions. The impact of this will vary from region to region, complicated further by fiscal policy responses in the run-up to, and following, the aforementioned elections. Whilst we don’t know what the future holds, our role is to adapt to an ever-changing world and allocate capital to the best opportunities to ensure we deliver on your stated goals and ambitions. With that in mind, please find below our market outlook for 2024.

MARKET OUTLOOK

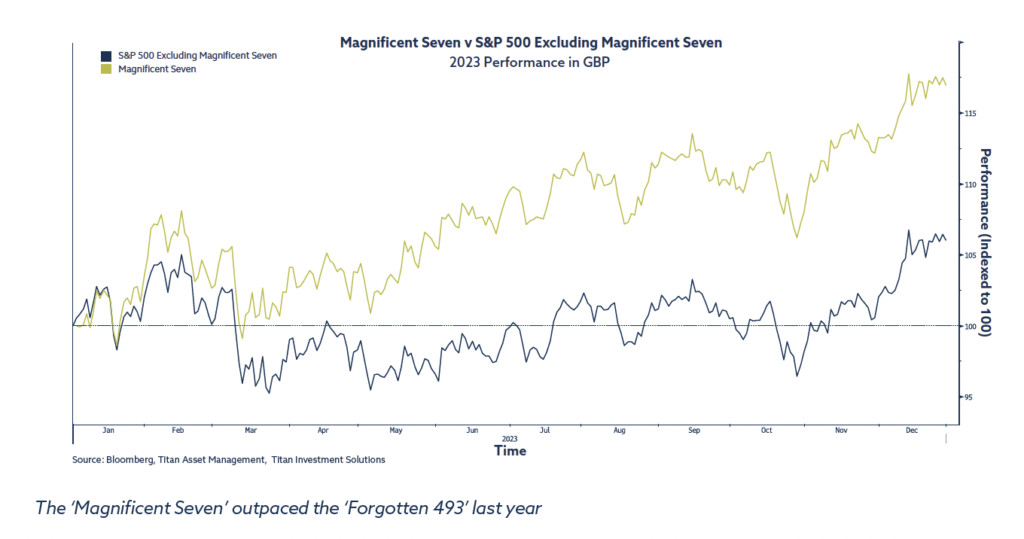

The ‘Magnificent Seven’ have driven markets higher this year, but we remain mindful of the ‘Forgotten 493’.

The former references a famous movie from the 1960s, where a band of bothers come together to liberate a town on the western frontier from a robber baron and gold mining tycoon. At risk of spoiling the plot, the Magnificent Seven see off the bad guys, liberating the town. At the end of the movie, one of the town elders states the villagers had won and the Seven are “like the wind, blowing over the land and passing on”.

From a market perspective, the phrase refers to seven high-flying stocks that were responsible for 95% of US equity market returns last year, namely: Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta (formerly Facebook) and Tesla. Like the gunslinger heroes of the movie, these are the stocks that came to the rescue. Strip out these names and the remainder of the US equity market delivered comparatively lacklustre returns.

The ‘Forgotten 493’ makes reference to the rest of the US equity market. It helps explain a simple premise, that equity market performance should broaden this year. Like the movie, we expect the seven band of brothers to disband (likely into lower numbered catchphrases) allowing many unloved and maligned stocks to outperform and catch up as we progress through the year. This rationale is predicated on attractive valuations and the growing probability that the US economy will avoid recession, which many economists forecast throughout 2022 and 2023.

We are focused on the US, and high-quality companies within the Forgotten 493, given attractive relative valuations and, at a regional level, the upbeat economic outlook versus the UK or Europe where weakening data and economic headwinds pose ongoing challenges. Elsewhere, we continue to like Japanese equities given positive structural reforms in the country which are now showing signs of fruition.

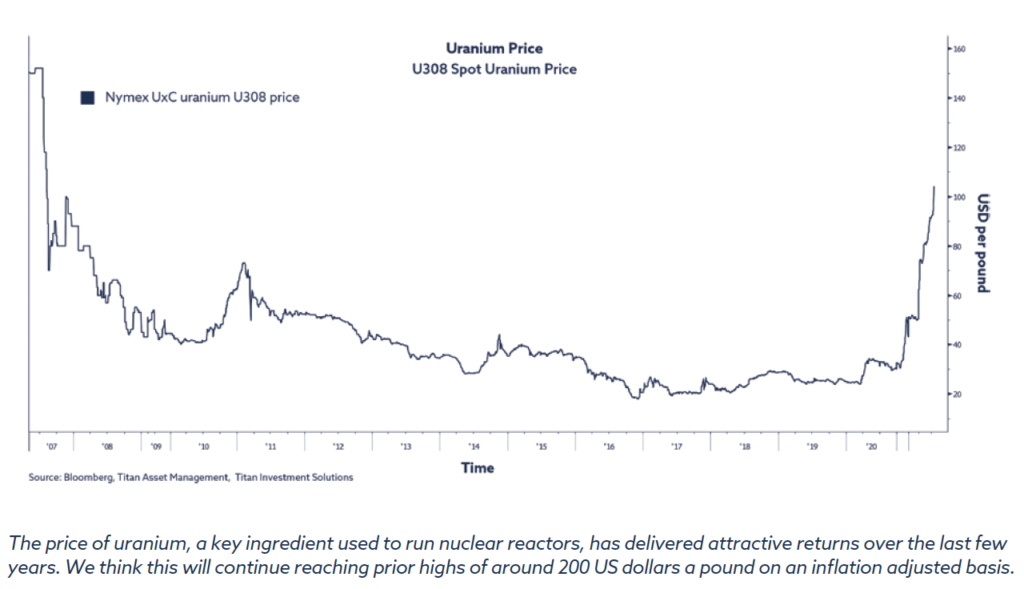

Sticking with equities, our greatest conviction this year, from a megatrends or thematic investment perspective, is nuclear energy. We see a significant upside in this differentiated sector given the meaningful pivot we have seen, in recent months, towards nuclear as a pragmatic way to solve the world’s growing energy requirements whilst striving to achieve net zero carbon aspirations. Huge government-backed demand, recently agreed at COP28 (the United Nations Climate Change Conference) will continue to eclipse the supply of the raw commodity, uranium, required to run nuclear reactors. This will drive prices for the commodity, and companies operating in this space, meaningfully higher through 2024 and beyond. You can read more on this topic in our latest blog. Given this entails underlying exposure to commodities (uranium), and our high conviction to the strategy, we have little exposure to this asset class elsewhere within our alternatives allocation. This position also comprises the majority of our emerging market equity exposure where we retain a neutral allocation, given our ongoing concerns over the Chinese economy which makes up 30% of the emerging market equity index.

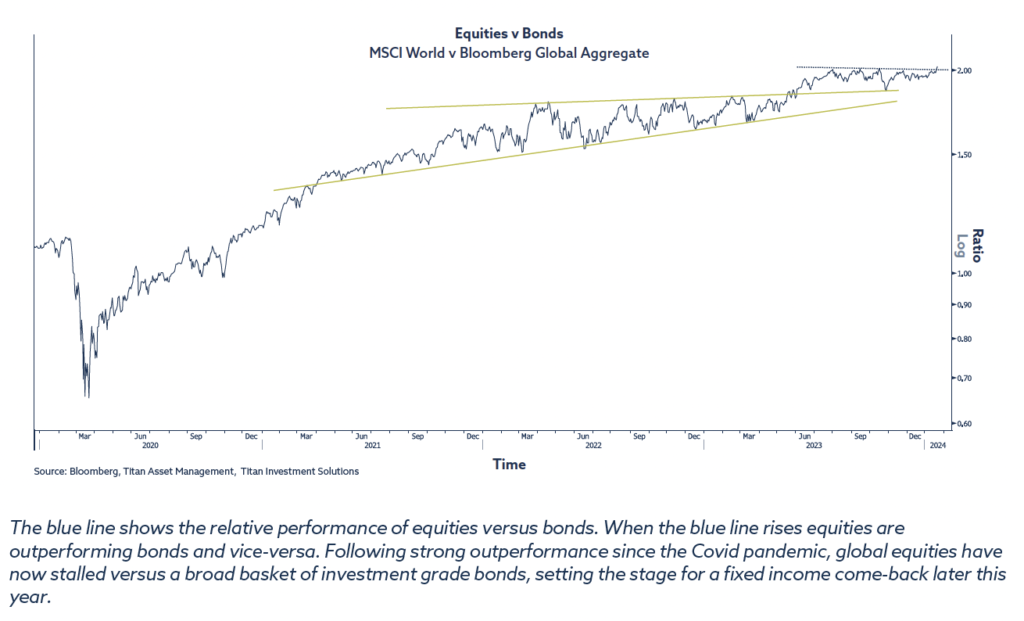

Another key theme for 2024 is fixed income. For many of the last few years, fixed income has underperformed equities and failed to provide the required diversification benefits when used within a multi-asset portfolio. But we think that could be set to change this year as inflation, and inflation uncertainty, continue to fall and many regions, primarily outside the US, continue to grapple with economic headwinds given the lagged impact from one of the fastest rate hiking cycles of the last few decades. We have been underweight duration (invested in short maturity bonds) throughout 2023, which worked well running into the fourth quarter before markets started to price in peak interest rates, and aggressive rate cuts, alongside a dovish shift in central bank communication. We started extending the duration towards the end of 2023, primarily via UK and European government bonds, given our outlook for these regions. We remain underweight Japanese bonds given the eventual exit from negative interest rate policy later this year.

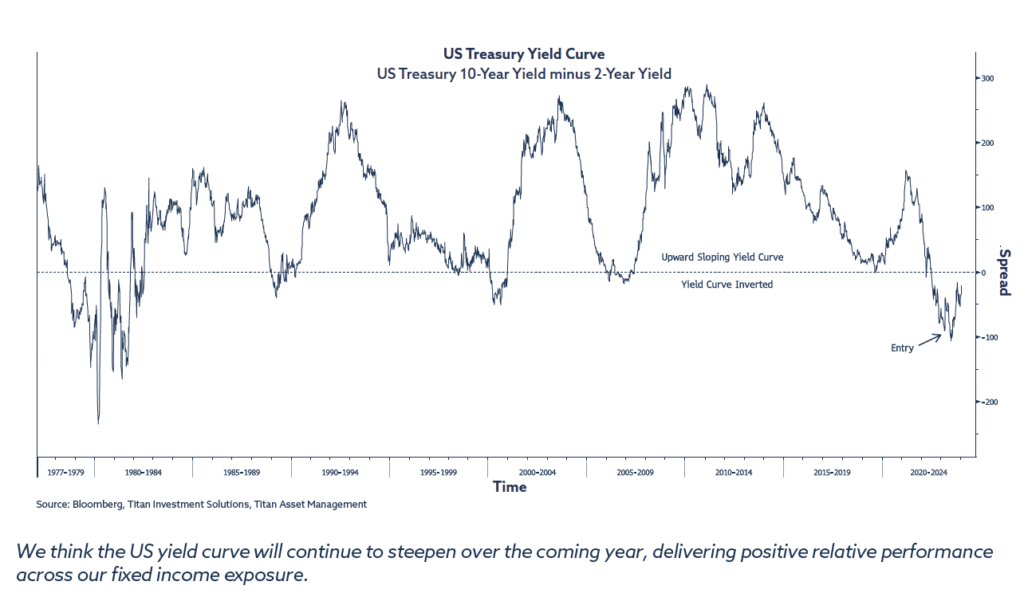

With yields at attractive levels, and the potential for lower rates providing an additional tailwind via increased bond prices (yields move inversely to prices), we think now is the time to gradually increase exposure to this asset class. We particularly like high-quality corporate credit given historically attractive valuations. In the US we like the yield curve steepener trade. The curve has been inverted for several years now (short-dated bond yields higher than long-dated yields) and we see a reversal towards a normalised curve structure (short-term yields lower than long-dated yields) as recessionary risks recede and monetary policy continues to normalise.

Finally, looking at currencies, we continue to like the US dollar given the relative economic backdrop and interest rate differentials which should continue to support the currency, despite longer-term concerns around the elevated US deficit which recently topped half a trillion dollars. As such we remain unhedged across our US equity exposure. We continue to hedge our see-through euro and Japanese yen currency exposure.

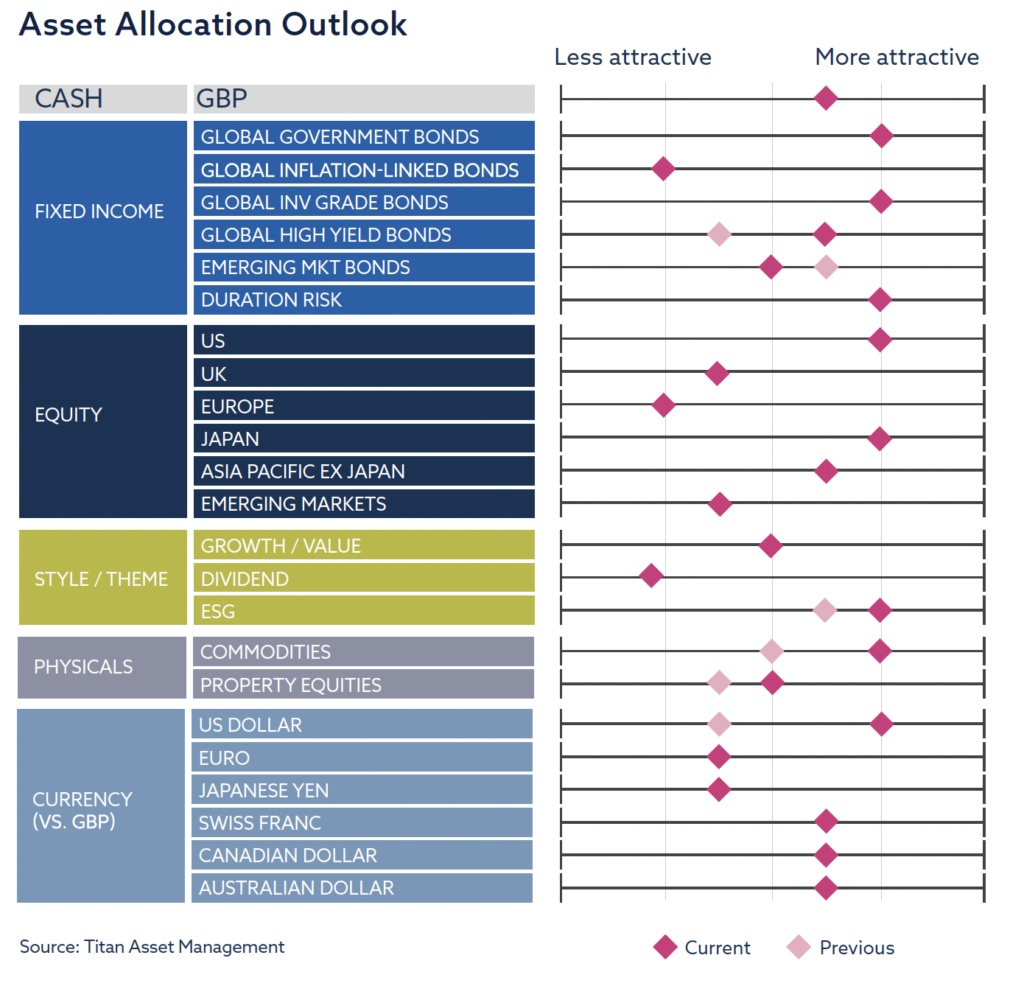

Please find on the next page a table showing our asset allocation outlook for the coming year. We update this table on a quarterly basis to show our latest thinking and any changes versus the prior quarter.

Following our last report, we have made a number of changes to our asset allocation outlook:

- Increased preference for high-quality high yield bonds

- Reduced preference for emerging market bonds from overweight to neutral

- Increased outlook for commodities from neutral to overweight, although this is specific to uranium

- Increased preference for ESG strategies given attractive valuations and upside potential in the clean energy space, specifically via nuclear energy

- As a deeply unloved asset class, and our contrarian contender for 2024, we have increased our outlook for REITs from underweight to neutral given attractive relative valuations and the prospect for lower yields (although this outlook is conditional on specific regional and sub-sector exposure)

- Preference for unhedged US dollar equity exposure for GBP-denominated clients

Q4 2023 – Sustainable investment report

SUSTAINABLE INVESTING The purpose of this section is to introduce sustainable investing and, importantly, explain our approach to sustainable investing. In 1987 […]